Kearney study: Boost in manufacturing productivity overcomes global economic uncertainty

As investors prepare to slowly dip their toe into global investment, their first step increasingly is in the United States.

That is one of the results of the latest Foreign Direct Investment Confidence Index, published by global management consulting firm A.T. Kearney. The index puts the U.S. at the top of the list, and reflects the continuing trend of both American manufacturing bringing previously outsourced jobs back to the U.S. as well as greater confidence from foreign firms looking to locate in this country.

The cloud on that horizon, according to the report, is that one-third of companies still are taking it slowly about reinvesting following the recession crash five years ago. But most companies already have seem a return to their pre-recession budget levels, and growth, however slow, also seems more likely than at any point since 2008.

“While investors are still in a holding pattern as they have been since the recession, they seem more optimistic and less jittery than they have in recent years,” said Paul Laudicina, chairman emeritus of A.T. Kearney and chairman of its Global Business Policy Council. “There’s been a leveling effect this year between developed economies and developing nations in terms of foreign investment. The world seems to be slowly finding its footing.”

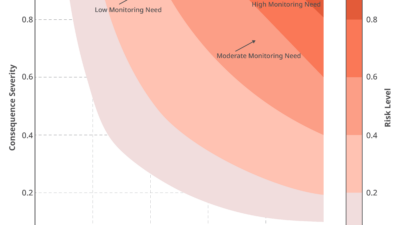

For the first time since 2001, the U.S. overtook China as the top country for foreign direct investment confidence. Developed countries led the resurgence, as confidence levels were higher for most developed countries across the board. Even Europe, still mired in its own debt and financial crisis, placed seven countries in the top 20 (see chart below).

“A variety of factors—including high-impact weather events, the Eurozone crisis and stagnation in economic recovery, China’s rising labor costs, and the U.S.’s own slow recovery in the face of fiscal uncertainties in Washington—continue to make corporate investors jittery about the short-term future,” Kearney officials said in a press release. “Half of respondents said they are more optimistic about the global economy than they were a year ago. Still, just 34% of corporate investors expected the global economy to recover to pre-recession levels by 2014. “

“Rather than a temporary safe haven during economic upheaval, emerging markets are developing into a complement, instead of an alternative, to the developed world,” said Erik Peterson, managing director of A.T. Kearney’s Global Business Policy Council. “The lines are blurring. Executives are deploying strategic planning tools to understand that the risk and reward of investing in emerging markets is converging with those of developed economies.”

The United States reclaimed first place in this year’s index for the first time since 2001. Investments during 2011 were up 15% from 2010, reaching $226.9 billion. That’s below the pre-recession peak of more than $300 billion but still tops in the world for the sixth straight year.

“U.S. manufacturing productivity has been on the rise since the recession. After downturn-induced cutbacks, companies made the best of a bad situation by investing in productivity-enhancing tools and equipment. Coupled with a weaker dollar and rising wages in developing countries, these gains have the potential to bring long-term benefits to the U.S. economy,” Kearney officials said in a press release. “However, 77% report that their investments have been affected by the current uncertainty and political brinkmanship surrounding the U.S. federal budget.”

China’s situation continues to revolve around labor, quality and productivity issues, although 73% of respondents said they would continue to manufacture in China despite the wage increases.

“With many of the gains in productivity of the past few years now exhausted, companies themselves will need to generate efficiency gains by improving communication and processes, enhancing speed and flexibility, implementing new technologies, and developing talent,” Laudicina said.