Industry expert describes developments

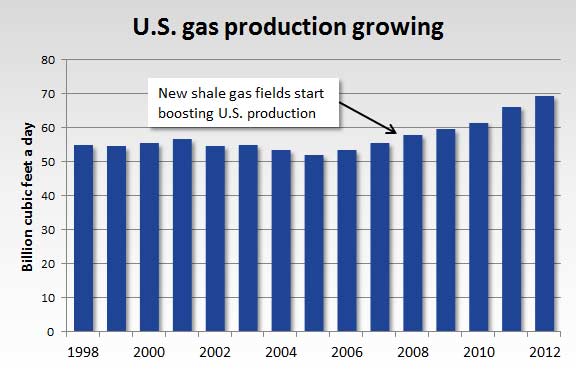

Increasingly, we see evidence that recent expansion of natural gas resources and stable prices are encouraging industrial development in the U.S. and Canada. In some cases, industries with significant energy requirements are returning to North America from overseas locations. Ross Eisenberg is Vice President, Energy & Resources Policy for the National Association of Manufacturers, and he shares with us his thoughts on the influence of the recent natural gas expansion.

Already Underway

Asked if he felt the increased resource base and moderate pricing of natural gas has the potential to increase the U.S. manufacturing base, he is emphatic. “Not only do we believe this will happen, we are already seeing it.” As examples, he cites a $750 million iron facility in Louisiana being developed by Nucor, and its $3 billion joint venture with Canadian oil and gas producer Encana for 20 years of access to its natural gas wells.

Other examples cited included a $2.1 billion expansion of fertilizer facilities by CF Industries, and another $1.4 nitrogen fertilizer facility being built by Orascom Construction Industries in Wever, Iowa. Eisenberg indicates there are many other examples of industrial startups or expansions that are directly tied to natural gas supply expansion.

Expanding Energy While Reducing Emissions

He notes, “At NAM we believe in an “all-of-the-above” energy resource policy, and natural gas is a major part of it.” Regarding greenhouse gas emissions, he says, “Through greater efficiency and fuel diversity, we’ve been able to make major reductions in our greenhouse gas emissions. We believe we should be focusing on developing the technologies necessary to continue to make these reductions rather that simply phasing our particular fuels.”

Chemicals Industries First Winners

Asked which industries could be most positively influenced by growing natural gas resources and their moderate cost, Eisenberg gives several examples. “To date, chemical manufacturers have been the largest beneficiaries, owing to less expensive ethane, a natural gas liquid derived from shale gas. Other energy intensive industries like fertilizer, iron & steel, aluminum, and plastics have begun to take advantage in recent years. We believe the next big step is going to be from the products that use natural gas-derived chemicals as building blocks.” As examples, he cites chlor-alkali used to make diverse products such as siding, pipe, flooring, coating and adhesives, toothpaste and cosmetics. Other chemicals such as ethylene and propylene are used for many plastic products.

Contribute to Economic Health

Eisenberg notes that global research firm IHS released a study finding that unconventional oil and gas activity already supports more than 2.1 million total jobs and has increased disposable income by $1,200 per U.S. household and added $284 billion to the U.S. gross domestic product in 2012.

He points out, “Thanks to newfound supply and price stability, manufacturers in the United States enjoy natural gas prices considerably lower than in China, India, Brazil, Japan and the United Kingdom.” Eisenberg explains that this is very important, because due to domestic tax, tort, and regulatory policies, it is now 20 percent more expensive to manufacture in the U.S. than any of its nine largest trading partners. He feels that the U.S. has a slight advantage with energy costs, and with the right policies, this advantage can grow.

Correct Policies Needed for Future

Finally, he cautions, “As bright as the future looks for energy in the U.S., we remain concerned that the wrong government policies can threaten manufacturers’ competitive advantage. So as bright as the future seems for energy, the right policies still matter.

MORE INFO:

Energy Solutions Center “Natural Gas in a Smart Energy Future”

Marcellus Shale Coalition, Reports on Shale Gas Development and Issues

U.S. Energy Information Administration Data on Natural Gas Resources