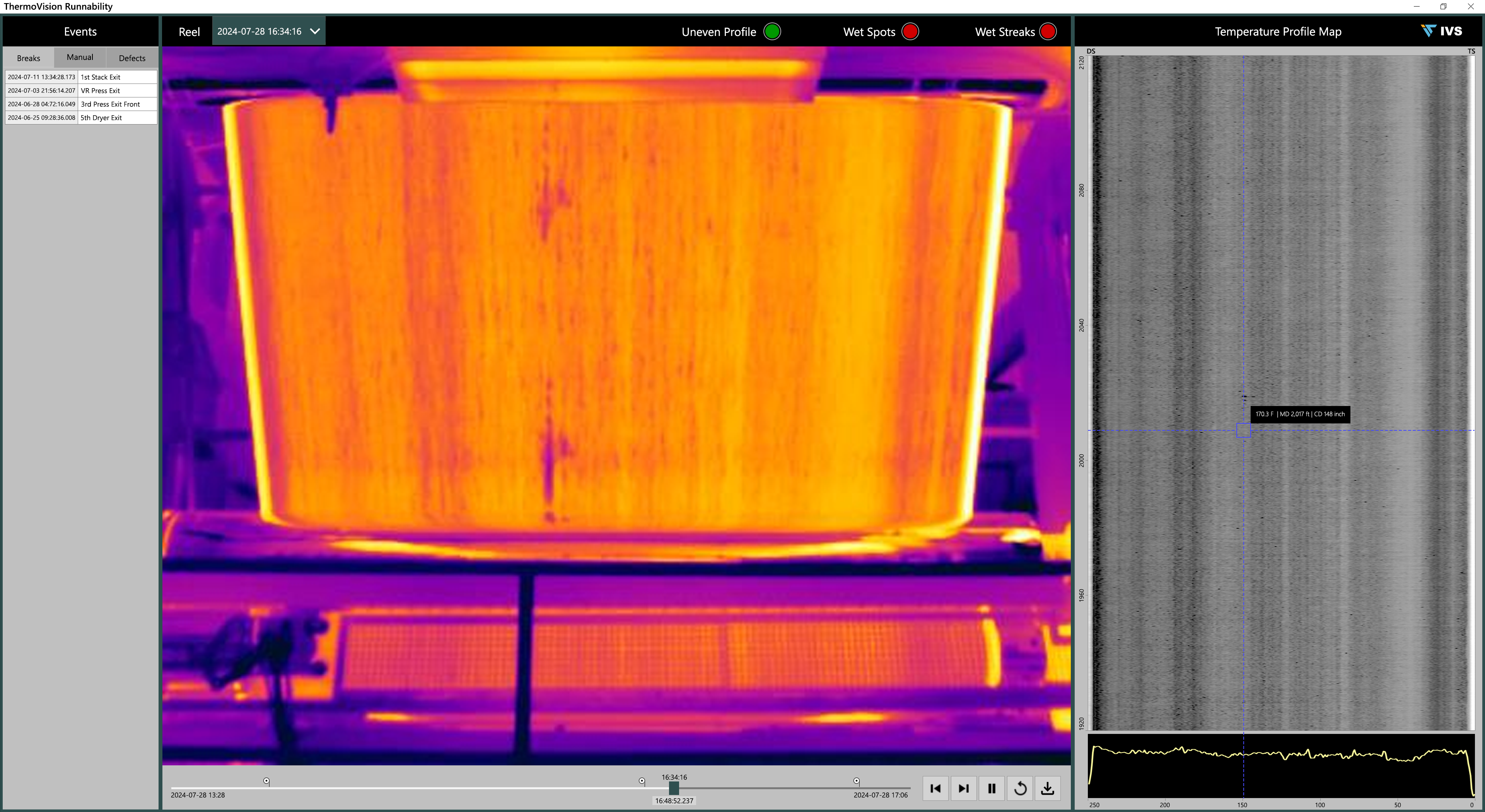

There are several factors in crucial areas of the motor and drive supply chain to note as the Russian invasion of Ukraine continues. See video.

The war Russia has waged on the Ukraine has heavily impacted global commodity markets. While oil & gas supply disruption and the resulting increase in price continue to dominate headlines, there are several other key materials exported by Russia and Ukraine which have been equally disrupted. The disruption of these materials will have both direct and indirect impacts and caused disruptions in motors and drives.

There are several factors in crucial areas of the motor and drive supply chain to note that can help suppliers prepare their businesses for what is to come and manage the expectations of their customers as the situation continues to unfold.

Video: Blake Griffin discusses these topics further with CFE Media web content manager Chris Vavra in an interview.

Aluminum and copper wire supply will be directly disrupted

The impact on the supply of key materials is two-fold. First, the economic sanctions placed on Russia will impact its ability to sell various products to its customers. Second, the war in Ukraine will impact its ability to produce and ship its key exports. As it pertains the production of motor and drives, the most direct impact stems from the disruption of aluminum and copper supply chains.

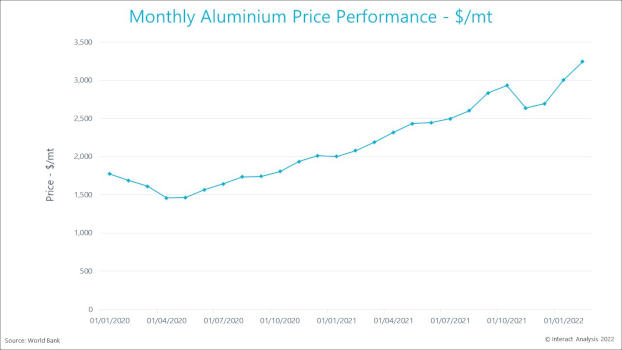

Russia is responsible for approximately 6% of the global aluminum. After significant COVID-19 related supply disruptions, which resulted in a steady rise in price over 2021, it appeared that supply and demand were beginning to stabilize. In late 2021, the world bank had forecast a price increase of 5% during 2022 for aluminum. Now that a war has broken out, Interact Analysis expects that price forecast to be on higher. The impact is being felt, with aluminum prices climbing to record highs in February this year.

Copper is in a similar position. While Russia is not as significant of a player in the raw copper market as it is in the aluminum trade, the country still produces 5% of the world’s supply.

Russia’s plays a larger role in the copper wire market. 7% of the world’s supply of copper wire, the same used in induction motors, comes from Russia. This will have an immediate impact on the cost and availability of copper wire used in induction motors.

Copper and aluminum make up approximately 16% of the cost of induction motors (including wages). The supply disruption these two commodities have seen due to war will be felt throughout 2022 in the form of a higher bill of materials. The motor market had already experienced price increases during 2021 because of increasing raw material costs. Price increases are expected to continue into 2022, furthering the disruptions in motors and drives.

The indirect impact of neon

Neon is expected indirectly to impact the production of drives during 2022.

The semiconductor shortage has been a major concern for motor drive suppliers. Throughout 2021, the shortage of this key motor drive component caused delays in the production process, resulting in extended lead times across the motor drive market. Neon gas, while not directly used in the manufacturing of motor drives, is used heavily in the production of semiconductor chips. The gas is used in the etching of silicon using high-powered lasers during the lithography step of the semiconductor production process.

Two companies based out of Ukraine account for about half of the worlds neon supply. Both companies have halted operations amidst the Russian invasion. As a result, semiconductor suppliers, which are already facing a supply/demand imbalance, will face additional production challenges stemming from a significant neon shortage.

Semiconductor suppliers had pointed to Q4 2022 into Q1 of 2023 as the timeline for when the shortage of semiconductors would begin to resolve. Fortunately, many of these same suppliers have been stocking up neon supply ahead of the war. However, if the conflict does not resolve, these stockpiles could run out. Should this occur, the semiconductor supply would fall into disarray and drive suppliers would face sourcing problems similar to the ones at start of the semiconductor shortage in early 2021.