New research shows the warehouse automation software market was valued at $2.4 billion in 2021 and will grow with a CAGR of 16% through 2027.

Warehouse automation software insights

- Warehouse automation software market worth $2.4 billion in 2021 and is estimated to reach $6 billion by 2027.

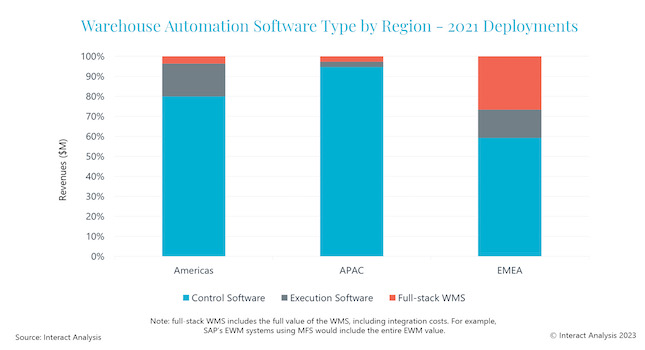

- Full-stack warehouse management systems (WMS) solutions are most popular in Europe, but not as familiar in the United States.

- Dematic and SAP are key players in the software market.

Research by Interact Analysis shows the market was valued at just under $2.4 billion in 2021 and will grow with a CAGR of 16% out to 2027. By the end of the forecast period, the market is predicted to be worth just under $6 billion. Warehouse automation software is defined as software used to control, execute, and manage the operations of automated warehouses. There are four main layers of warehouse automation software: sub-ordinate control software, control software, execution software, and management software.

Control software will remain the largest segment throughout the forecast period to 2027. However, there are some key differences when it comes to the type of software stack customers in different regions choose to invest in. In Europe, it’s far more common to see Full-Stack WMS solutions where a single software solution provides end-to-end control from the management functionality all the way down to the control and PLC integration. On the other hand, full-stack WMS solutions are seldom seen in the US. Most automated warehouses in the US use third-party WMSs, such as those solutions offered by Manhattan Associates or Blue Yonder. Interact Analysis suggests that European decision making is influenced by confidence in allowing automation vendors to take charge of the management functionalities in the warehouse. Additionally, the dominance of SAP in Europe has popularized full-stack WMS solutions.

Warehouse execution software, which is used to orchestrate and optimize the timing and location of order processing in order to maximize throughput, has gained the most traction in the US. Warehouse execution software emerged as a solution to the complexities of omni-channel fulfillment where the traditional wave-based approaches to picking made it challenging to prioritize and expedite single orders. Furthermore, the shift from ‘islands of automation’ to end-to-end automation solutions required a layer of orchestration that would sit on top of the various WCS solutions controlling each point solution.

Full-stack WMS solutions are most popular in Europe and rarely seen in US and APAC warehouses.

Rueben Scriven, Research Manager at Interact Analysis, said, “Revenue growth for the warehouse automation software market largely correlates with the warehouse automation market. Without the hardware, there is no need for the software. Dematic and SAP are key players in the software market, with Dematic accounting for the largest market share in 2021 (9%). SAP is the largest vendor that does not sell hardware, registering just under $100m in revenue for 2021. Overall, SAP – along with SAP consultants – accounts for around 15% of warehouse automation software revenues. Other emerging players to keep an eye out for in the market include Koerber, Symbotic, TGW and Knapp.”

– Interact Analysis is a CFE Media and Technology content partner.