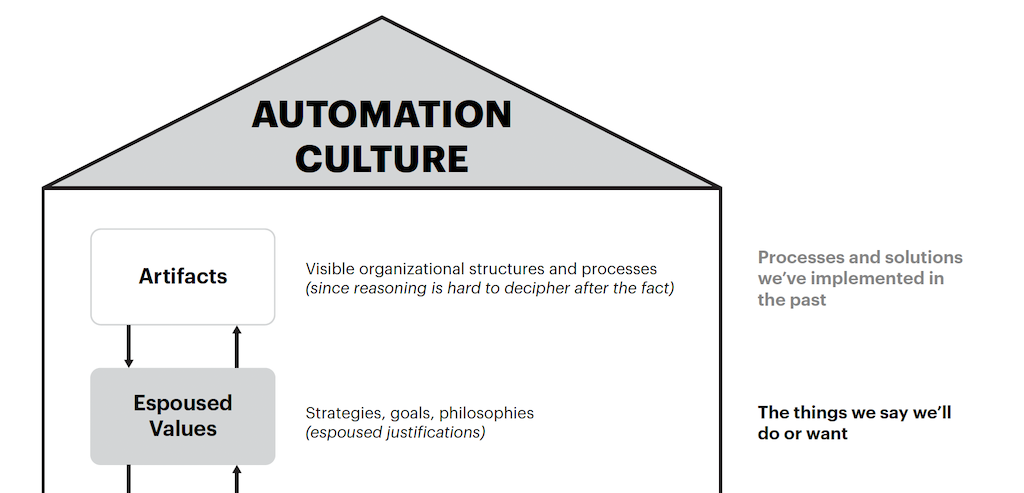

Pressures from oil prices, a weaker dollar and the West Coast dock strike weigh down index; PMI falls to 51.5% in March. The PMI remained above the 50% growth threshold for the index to extend the streak to almost six years; the 51.5% PMI for March still translates to a 2.6% growth in gross domestic product for the year.

The measuring stick for U.S. manufacturing declined for the fifth straight month in March, dropping to its lowest point in two years. The Institute of Supply Management PMI Index fell to 51.5% from 52.9% in February, as industry experts suggest a combination of labor, economic and environmental issues all put pressure on the manufacturing landscape. The PMI remained above the 50% growth threshold for the index to extend the streak to almost six years; the 51.5% PMI for March still translates to a 2.6% growth in gross domestic product for the year.

Since hitting a six-year high in August 2014 at 58.1%, the PMI Index has leveled off and then slumped. The fundamental causes of the drop, according to theInstitute of Supply Management’s Manufacturing Business Survey Committee, is a combination of issues that don’t have anything directly to do with manufacturing operations.

"Comments from the panel refer to continuing challenges from the West Coast port issue, lower oil prices having both positive and negative impacts depending upon the industry, residual effects of the harsh winter, higher costs of healthcare premiums, and challenges associated with the stronger dollar on international business," said Bradley S. Holcomb, chairman of the committee.

In fact, half of the 18 reporting industries reported growth in March, raw material prices fell for the fifth consecutive month and the Production Index was unchanged.

Among the comments from committee members:

- "Falling energies have helped on the cost side while sales are getting a boost through improvements in consumer disposable income." (Food, Beverage & Tobacco Products)

- "Our business is still strong and on projection. Dollar strength is challenging for our international business." (Fabricated Metal Products)

- "Business is still extremely strong." (Transportation Equipment)

- "Oil prices impacting drilling and project activity. Pursuing cost reductions from suppliers for a wide variety of goods and services." (Petroleum & Coal Products)

- "Business really starting to slow down. Oil pricing is having a major effect on energy markets." (Computer & Electronic Products)

- "Operating costs are higher due to increases in healthcare premiums." (Miscellaneous Manufacturing)

- "March business is improving over Jan-Feb, thawing out of this crazy winter." (Paper Products)

- "Dealing with ongoing delivery issues associated with congestion at the U.S. West Coast and Vancouver ports." (Machinery)

– Bob Vavra is content manager, Plant Engineering, [email protected]