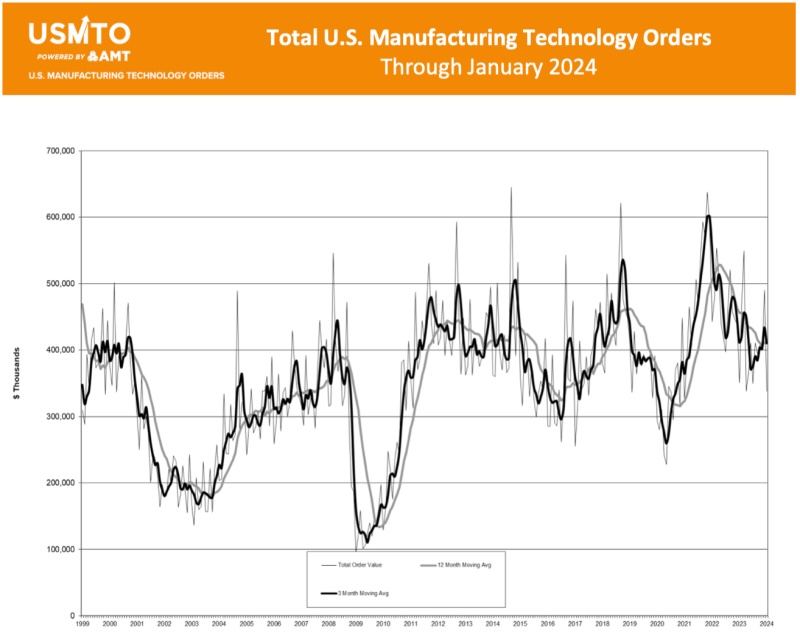

Manufacturing technology orders totaled $338 million in January 2024, a 31% decline from December, but only a 3.7% decline from January 2023.

Manufacturing technology orders insights

- January 2024 saw a 31% decrease in manufacturing technology orders from December 2023, with orders totaling $338 million, marking the lowest January level since 2021 and the lowest unit count since 2016.

- Contract machine shops, the main customers for manufacturing technology, experienced a significant drop in orders, reaching their lowest point since July 2023, indicating a downturn in business activity.

Orders of manufacturing technology, measured by the U.S. manufacturing technology orders report published by AMT — The Association for Manufacturing Technology, totaled $338 million in January 2024, a 31% decline from December and a 3.7% decline from January 2023. The value of orders in January 2024 were at the lowest level for a January since 2021, yet the unit count was the lowest since 2016. This indicates the demand for manufacturing technology is still being driven by orders of highly specialized, automated machinery.

- Contract machine shops, the largest customer of manufacturing technology, decreased orders in January 2024 to the lowest level since July 2023, a 27.1% decline from December 2023. These shops have been ordering below their typical share for some time now. Should business conditions improve for these manufacturers, there is a large upside potential for future orders of manufacturing technology.

- Contract machine shops are expected to continue experiencing subdued order activity in the near future. Despite a minor improvement in February 2024, the Gardner Metalworking Index — compiled by Gardner Business Media and predominantly based on responses from contract machine shops – indicates that the downturn in business activity is likely to persist for at least another month.

- Outside of the aerospace and automotive sectors, OEMs in many other industries are generally small consumers of manufacturing technology in any given month relative to the size of orders from contract machine shops. However, for some time now, this has inverted, as OEMs across several industries have increased orders at a pace that has nearly offset the decline in orders from contract machine shops.

- Manufacturers of oil and gas field machinery were among the OEMs increasing orders in January 2024. According to data published by the Texas Oil and Gas Association, 2023 set records in both the extraction and refining of oil and natural gas in the state. In recent years, elevated orders for manufacturing technology from this sector have typically been placed in the fourth quarter of the year. The early uptick in 2024 could indicate an appetite to expand capacity and modernize equipment to compete with recent regulatory hurdles.

January is typically the slowest month for manufacturing technology orders in any given year, and 2024 may prove to be no different. Forecasters at Oxford Economics have predicted that global industrial production will increase 2.7% in 2024. This bodes well for manufacturing technology, as even non-durable goods producers require machinery that is built using the metalworking equipment tracked by USMTO. Indeed, Oxford Economics also presented a forecast at AMT’s Winter Economic Forum, predicting that manufacturing technology orders in the United States would increase nearly 8% in 2024.