Daily Insight: Enterprise mobility is more than just an app

Mobility on the move: The annual Syclo user group meeting took on new meaning this year after the mobility software leader was acquired by SAP earlier this year. So a packed room in Chicago today was anxious to hear what Syclo had planned for the mobility space and what SAP had planned for Syclo.

Citing figures that showed the meteoric rise of mobility devices in the plant and in the home, Syclo founder Rich Padula said “You need to unlock business value by unlocking consumer applications to the enterprise. You need to take a strategic view of mobility.

“Too many times I see companies take a short-term view of mobility,” Padula added. “When it’s time to upgrade and I want to integrate systems, sometimes the platform can’t support it. You wind up with a mobile soup.”

Padula told the overflow crowd that the partnership between Syclo and SAP will build on SAP’s overall view of mobility as a pillar of its future business. While Syclo will continue its own applications and R&D, it also will be able to deploy additional applications from inside and outside SAP’s core business. “We have a single vision for mobility in the marketplace,” Padula said.

That view was echoed by Sanjay Poonen, president of SAP Mobile Strategy. “We’re moving at a pace that is incredible – months, days and weeks instead of years,” said Poonen. “There are now more devices than the population of the world.”

And with 40 apps per device, the opportunity to deliver project specific applications to mobile devices is increasing on a daily basis. “Mobile is the new desktop,” Poonen said. “We think there will be a huge opportunity for society to reinvent itself.”

In linking arms with Syclo, SAP also is acknowledging its need to be device-neutral. One longtime Syclo partner is IBM, which deploys the popular Maximo enterprise asset management system. “We’re going to double down on our Maximo investment,” Poonen said.

Investing in the future: Padula offered a compelling view on how and why companies need to invest in mobility systems in particular. He also talked about why they needed flexible and dynamic systems in general. He compared it to another important investment – retirement.

“You need to treat your mobile investments with a financial approach,” he said. “To have happy retirement, you need a steady return on your investment. Mobility ought to be the same way. You need to stay current with the market. You need to look across organization and see what areas benefit from mobility. And you need to manage that risk.

“You need to invest in core applications, in new or additional business process, and in user experience and new technologies. You’ve got to see how can improve the user experience,” Padula added. “You want to make sure you have a balanced portfolio and to keep on top of trends.”

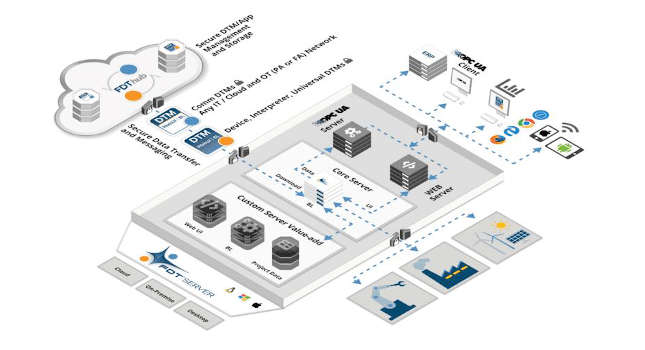

A side note on the Cloud: Padula and Poonen both said cloud computing is a critical part of SAP’s overall strategy, and a critical need for all users of mobility. “If you don’t think cloud first, going to be left out,” Poonen said.

But new solutions also create new problems. For example, if you put a document in an open-source cloud site, that document now exists outside your own firewall. SAP created a storage system called SAP Box inside a network firewall to keep such documents sharable, but secure. Poonen noted that application came from internal users citing a need, noting that many solutions within SAP’s system come directly from customer applications and innovations.

BRIEF INSIGHTS:

Machine vision growth to slow: Instability in the Eurozone and an unsustainable growth rate will result in a slower rate of growth for the machine vision market, according to a recent report from IMS Research.

While machine vision revenues grew more than 10% in 2011, IMS researchers said that level won’t continue into 2016. “The main reason for the restricted growth of this industry is considered to be instability in many economies around the world, particularly those countries that have adopted the Euro,” said report author John Morse. “The machine vision industry recovered well after the last recession as shown by the results of IMS Research’s free quarterly market tracker. However, revenue growth showed signs of slowing in the second half of 2011. Many manufacturers expressed caution about growth in 2012 and beyond.”

The strength in the market will be from new uses for machine vision in areas such as security, surveillance and medical uses. Still, 80% of the machine vision market will continue to be in manufacturing.