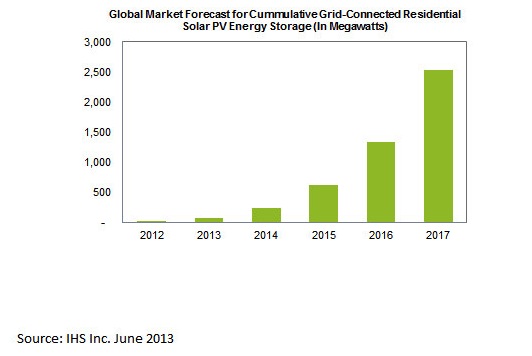

IHS reports that the residential PV market is expected to reach 2.5 GW of storage by 2017 because of reduced costs and tariffs, particularly in Europe.

The market for residential photovoltaic (PV) energy storage systems is expected to boom in the coming years, with cumulative installations amounting to 2.5 GW by 2017, equivalent to the solar power that could be generated by more than 600,000 homes.

Kick-started by the introduction in May of the German Energy Storage subsidy, cumulative installations are forecast to grow to these heights from a trivial 12 MW in 2012, according to a new report entitled “The Role of Energy Storage in the PV Industry” from information and analytics provider IHS Inc. The number of PV residential energy storage installations will be greater than the total number of residential solar systems in Germany today.

“Residential PV customers are striving to maximize their own consumption of the energy they are generating,” said Abigail Ward, PV analyst at IHS. “This is because rising electricity prices and decreasing feed-in-tariffs (FiTs) are serving as a disincentive for consumers to export their power to the electricity grid. Such developments, combined with the introduction of the German Energy Storage Subsidy, are forecast to accelerate the overall growth of the residential solar storage market.”

Disincentives

Financial incentives and subsidies, such as FiTs, have made it monetarily attractive for end users to send their excess electricity to the grid.

However, this is now rapidly changing in established markets. In many countries, incentives are subject to regular reductions following higher-than-anticipated growth in installations, and recent reductions in PV system prices. These reductions, coupled with continually increasing retail electricity prices, mean that self-consumption of energy on-site is a more desirable option for home owners.

Throwing the FiTs

In Germany and the United Kingdom, the FiT is declining at a steady rate.

For these countries, the current FiT rate paid for electricity exported to the electricity grid has already fallen below average retail electricity rates. As a result, PV system owners pay a greater amount for electricity imported from the grid than they receive for the energy they sell. Rather than export the energy generated in order to receive the FiT, it is now financially attractive to consume the energy generated by the system on-site.

“An energy storage solution enables a PV system owner to shift energy from when it is generated to a later time for consumption,” Ward said. “As a result, demand for residential energy storage products will continue to accelerate as PV energy reaches grid-parity in a number of countries.”

Nonetheless, at today’s prices, the financial gains to be obtained by growing self-consumption do not yet offset the increase in upfront costs associated with the addition of an energy storage solution in a residential PV system over the expected 20-year lifetime of the installation.

Residential PV storage prices to decrease by 45%

The introduction of the German Energy Storage Subsidy represents a turning point by increasing the return-on-investment of a residential PV system installed with an energy storage solution. At today’s prices, the financial gains to be obtained by growing self-consumption do not yet offset the increase in upfront costs associated with the addition of an energy storage solution in a residential PV system over the expected 20-year lifetime of the installation. The German program, however, can help.

“Not only will the incentive reduce the upfront cost of residential storage solutions deployed in Germany by up to 30%, it will also generate volume in this immature market—and price reductions achieved by mass production will also benefit installations in other countries,” said Sam Wilkinson, PV research manager and co-author of the report. “For battery-based residential PV energy storage systems, IHS predicts an average cost reduction of around 45% during the next five years, largely due to decreases in battery prices.”

Big growth for big systems

Cost reductions also are projected for larger PV storage installations, spurring growth for commercial and utility-scale systems.

“The market drivers for the installation of storage in large-scale systems differ significantly from those of residential systems,” Wilkinson noted. “Deployment in these massive systems is anticipated to shift from pilot demonstration projects to commercial installations during the next year, and annual installations for the total grid-connected market are forecast to reach nearly 6 GW in 2017.”