Oil moves higher; growing U.S. natural gas exports are among the trends expected to highlight 2017.

In November 2016, OPEC abandoned its strategy of using delivery of over-abundant oil supplies to starve out shale producers and other high-cost drillers. OPEC and non-OPEC producers agreed to cuts of more than 1.7 million barrels per day.

"Looking at the promised OPEC reduction, it’s wise to keep in mind that in recent years, in fact, for at least the last 20 years, the record of OPEC members adhering to these agreements has been spotty at best," said Laith Amin, SVP for Digital Enterprise North America at Advisian.

The record, in fact, indicates about 60% adherence to past agreements, and many believe this is what will transpire now.

"On the other hand, the present agreement is the product of fierce negotiations," Amin said. "Saudi Arabia’s traditional role has been that of a swing producer. They’ve grown tired of that role. They want to demonstrate their seriousness and that of others when it comes to production. Because this ignoring of quotas has been a hard lesson for them."

In early December 2016, the International Energy Agency (IEA) said it sees global demand growth of 1.4 million barrels a day in 2016 and of 1.3 million barrels per day in 2017. The energy watchdog group said that global inventories should start to shrink in the first half of 2017.

If the OPEC-brokered agreement is taken seriously, it will demonstrate a high level of cooperation not only within OPEC but also with non-OPEC members such as Russia, Amin said. "To a degree, this reflects the lessened influence of OPEC itself."

What follows from it

If the biggest producers with the lowest costs per barrel of oil, "limit their production so that the price of crude oil, already up to the $50 a barrel range, rises further, that will initiate supply coming from sources higher up the cost-curve. These include a portfolio of U.S.-based assets, such as shale, that do have higher costs," Amin said.

Amin said the ensuing market shift will mean that more supply will be coming from the U.S. "In fact, more quickly than we thought would happen, rig counts and increased activity in the U.S. are already happening," said Amin.

The rising price and expanded activity may be a surprise to others as well. As late as early December 2016 the U.S. Energy Information Administration (EIA) said U.S. crude oil production averaged 9.4 million barrels per day (b/d) in 2015, and it is forecast to average 8.9 million b/d in 2016 and 8.8 million in 2017, with an on-going commitment to lower costs.

If OPEC-based cooperation holds good, Amin believes oil prices will increase to the $60/bbl range. "But with the increased supplies, probabilities the price will rise to as high as $90 or $100 a barrel are slim," he said.

Gas goes its own way

Substantial increases in natural gas prices were seen in the U.S. in the last year, but, as Amin notes, there is still a long way to go. "Fundamentally speaking, natural gas is not as shippable or as tradable as liquids. For the present we’ll continue to be very well supplied except where the needed piping network and other infrastructure isn’t evident, such as in the northeast U.S.," he said.

It wasn’t that long ago in the U.S. that no significant increase in natural gas production was anticipated. What was looked for were significant imports. Now all that import infrastructure that was being built is being converted to export infrastructure. "In the next four to five years both U.S. coasts will be exporters of liquefied natural gas," said Amin. "Where importation was to occur, there is a lack of infrastructure for distribution of domestic production. Shale oil and gas took the industry by surprise."

International prices for liquefied natural gas (LNG) will be more generally of interest to U.S. producers in future. As the export terminals come on line, "International prices for LNG and greater levels of LNG export will tend to support international natural gas prices from falling too far."

In many international markets, oil is indexed to LNG, and "as oil prices increase LNG prices will recover from their lows of the last three or four years ago, exposing opportunities for arbitrage," Amin said. "These exporters will be very competitive, price-wise, under different market conditions."

Per the U.S. EIA Report, natural gas marketed production is forecast to average 77.5 billion cubic feet per day (Bcf/d) in 2016, a 1.3 Bcf/d decline from the 2015 level, which would be the first annual production decline since 2005. In 2017, natural gas production is forecast to increase by an average of 2.5 Bcf/d from the 2016 level.

The report further states that growing domestic natural gas consumption, along with higher pipeline exports to Mexico and LNG exports, will contribute to the Henry Hub natural gas spot price rising from an average of $2.49 per million British thermal units (MMBtu) in 2016 to $3.27/MMBtu in 2017.

NYMEX contract values for March 2017 delivery traded during the five-day period ending December 1, 2016 suggest that a price range from $2.20/MMBtu to $5.04/MMBtu encompasses the market expectation of Henry Hub natural gas prices in March 2017 at the 95% confidence level.

Administrations and regulations

In 2017 the EPA will be finalizing regulations related to fugitive methane emissions from on-shore oil and gas wells. It isn’t clear yet what means producers will use to meet these standards, and they are looking for innovation from industry suppliers.

Scott Pruitt, who will be the head of the Environmental Protection Agency for the Trump administration, will bring a new look to regulation of the oil and gas industry of which he is a part.

"It will be interesting to see how the appointment will change policy and how the industry believes these fugitive emissions can be cost-effectively controlled," Amin said.

Per its news release, the EPA is finalizing a set of standards that will reduce methane, volatile organic compounds (VOCs) and toxic air emissions in the oil-and-gas industry. The final standards, the agency says, will significantly curb methane emissions from new, reconstructed and modified processes and equipment, including sources not covered in the agency’s 2012 rules.

These sources include hydraulically fractured wells, some of which can contain a large amount of gas along with oil, and equipment used across the industry that was not subjected to the 2012 rule changes. In May 2016, the agency issued a request for information to the industries that includes inquiries as to what technologies industry players foresee being used to limit emissions.

While it may not prove easy for the new administration to actually rollback existing regulation, agency approval processes may be accelerated. Reports indicate that if the administration normalizes relations with Russia and lifts sanctions, we may see increased petroleum exports from Russia in the second half of the year.

Digital world

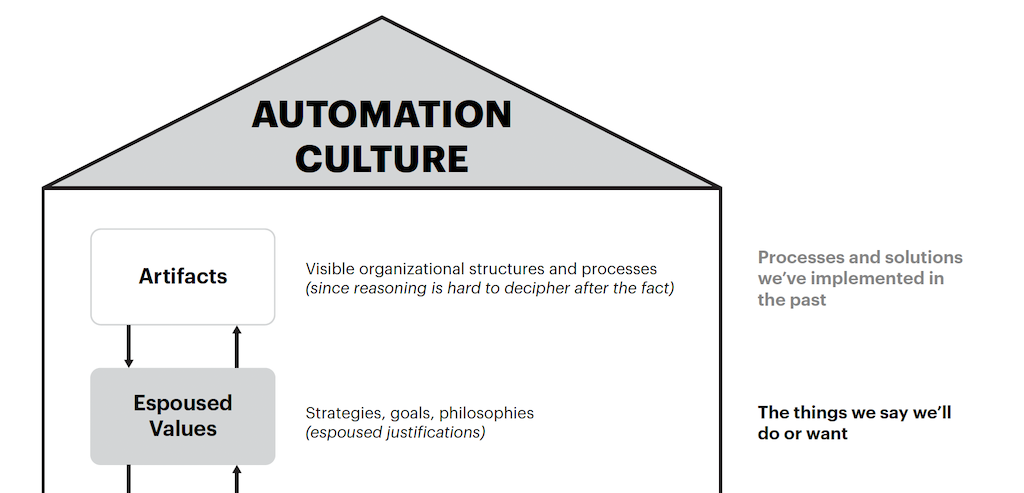

The "digitization" of oil and gas production and distribution is underway across the industry’s value chain, to the point where it has no news value: because it’s everywhere.

What’s less clear, Amin said, is what will be the form and function of the systems involved. They will begin gathering data during the construction and procurement and proceed to operations and management, that’s clear. "But one more good question is," Amin added, "what kinds of technologies do we see in the consumer world, or in industries outside oil and gas, that may be more advanced, that are relevant to oil and gas today?" A technology that may sound familiar soon is "machine learning." In machine learning, algorithms that detect patterns in large amounts of data support the identification of truth.

With machine learning, instead of writing applications with limited range, the idea is to collect the data and to learn the necessary algorithms from the data, writes Ethem Alpaydin, author of "Introduction to Machine Learning," part of the MIT Press Essential Knowledge Series.

Machine learning is the most important driver in artificial intelligence research today, and it is pushing computers into new areas where they may rely heavily on machine vision, sound or other areas where context most matters.

"The data contains instances of what is to be done, and the learning algorithm modifies a learner program automatically in such a way as to match the requirements specified in the data… Although the data is big, it can be explained in terms of a relatively simple model with a small number of hidden factors and their interaction," Alpaydin said.

"Look at Twitter and how it is used by humans," said Amin. "It may not be verifiable information all the time, but it is fast. One tweet brings other tweets in response. A kind of learning is occurring, proliferating to the participants. It’s an example of learning and adaptation in real time."

A learning program is different from an ordinary computer program in that it is a general template with modifiable parameters. By assigning different values to these parameters, "the program can do different things. The learning algorithm adjust the parameters of the template—which we call a model-by optimizing a performance criterion defined in the data," Alpaydin said. To anyone involved in process control or automation, this is not really a foreign language. The shifting of the parameters to better match the data is what is called "learning."

Emerging as commercial

Some first instances of these emerging systems are now available as commercial solutions. To take just one example, energy management and automation supplier, Schneider Electric, said its recently announced SimSci SimCentral for Process Utilities will prove an important piece in plant digitization. The model combines fluid flow, steady state, and dynamic simulation in a single environment, with process utilities as only the first function or unit to be modeled in the environment, which will eventually extend to a large set of the means of production found in a plant.

Users streamline process utility design and simplify modeling complexity. Benefits include reduced time and cost, appealing user experience, and accelerated process simulation and design.

Simulation tools used today by process engineers in the oil and gas, refining, and chemical industries trace their origins to legacy architectures, operating systems and user interfaces. Schneider Electric said SimCentral for Process Utilities is the first release in decades with a process simulator built from the ground up. Schneider emphasizes that the platform takes full advantage of current web and cloud technologies.

Users will include engineering, procurement and construction (EPC) firms, operating companies and process licensor organizations. WorleyParsons, an EPC professional services company, was an early adopter, having recognized an acute need for a better process simulation work environment.

"By removing complexity from engineering process modeling, SimCentral for Process Utilities lets WorleyParsons deliver more value and respond faster to our client’s needs," said Loïc Coyot, principal/lead process engineer at WorleyParsons.

"SimCentral gives process engineers a comprehensive application to visualize, test and implement process improvement at a speed and quality never seen before in our industry," said Tobias Scheele, senior vice president software, global solutions at Schneider Electric.

Features contributing to these results include:

- Unified lifecycle simulation – a model can be taken through all stages of the plant lifecycle, including design, training and operations

- Ease of use – a modern user interface puts user first, showing relevant features and libraries; role-based library views ease navigation, equation views are easier to see and change

- Expanded problem solving – an intuitive model writing environment unlocks new operations and equations modeling to solve simulation challenges previously considered unsolvable

- Unprecedented interactivity and control – a "continuously solved" approach is possible whereby changes to input variables can directly update all output variables

- Faster calculation speed – an advanced design accommodates public or private cloud computing environments to scale performance speed as needed

- Collaborative engineering – as a productivity feature, users can concurrently work on the same model across regional time zones, departments, or other organizations.

Final words

In the future, for any production plant, there will be a digital equivalent. For each production asset, as well, there will be a digital twin. "More and more these abstract, digital objects will communicate with each other," Amin said.

"If these objects can establish Twitter-like communications, the system is in a much better position to treat with anomalies. The operator, on the other hand, is looking at only the limited set of parameters visible to him. Ultimately the equipment will inform the operator based on diagnostics already performed."

The value for Amin is clear: "You don’t want people fooling around with settings. You don’t want people to leave the control room to spend time in less secure areas. You don’t want to have to shut things off or turn things down to perform diagnostics. Rather you rely on the machines to become a twitter-like community and learn from that."

What you end up with is an algorithm of considerable value. "The idea of an algorithmic model for the plant is become more practical and less theoretical," Amin said. "Machine learning is the first instance of a kind of algorithmic model. Models will focus on plant optimization, but also on how humans interact with the plant. Safety won’t be reactive but embedded in activities. Models will warn us when we’re going astray."

Across the value chain, assets will be enriched via machine learning. The algorithmic model will become an integral part of the plant’s value. And we’re moving very quickly to that.

Kevin Parker is a senior contributing editor to Oil & Gas Engineering magazine.