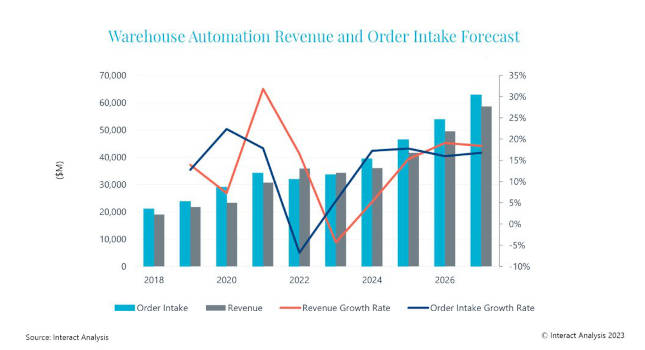

The warehouse construction industry had a correction due to COVID-19 and the shifting landscape, but the future looks brighter for the industry.

Warehousing insights

- The warehouse construction and automation industry is likely to increase in 2024 compared with this year and potentially return to double-digit growth in 2025.

- Warehouses are moving away toward just-in-case (JIC) supply chains when it comes to inventory management, which is crucial for e-commerce suppliers as they face increased demand for their products.

The initial signs of light at the end of the tunnel are being seen for warehouse construction and automation investment as e-commerce activity begins to stabilize. Having potentially hit rock bottom, the situation looks like it is starting to improve, with spending on automation likely to increase in 2024 compared with this year and potentially return to double-digit growth in 2025.

Our latest analysis indicates warehouse construction will show signs of improvement in 2024, following a projected 25% year-on-year fall in warehouses added to the building stock in 2023. The post-COVID boom in construction, driven by e-commerce activity, slowed during the last 12 months and commercial real-estate developers are seeing leaner times.

Declining growth in the e-commerce sector and rising interest rates have dampened construction, but the green shoots of recovery are starting to peek through. As e-commerce begins to stabilize (having dipped to pre-pandemic levels it is now picking up again as a percentage of total retail sales), commercial real estate developers are expected to see more activity during 2024 and 2025.

Warehouse automation to return to revenue growth in 2024

With e-commerce at the tail end of the post-COVID correction, coupled with the trend away from just-in-time (JIT) inventory management towards just-in-case supply chains, warehouse construction is forecast to return to growth from the end of this year, fueling demand for automation solutions during 2024 and into 2025, particularly in the US.

According to the mid-year update of our Warehouse Automation Report, warehouse automation orders will start to increase towards the end of this year, with growth continuing in 2024, pushing automation revenue growth back into double figures in 2025. The growth of warehouse automation order intake is tightly linked to the development of new greenfield warehouse sites which are forecast to rise in 2024, following a sharp decline in 2023.

Retail giants to continue investing in building stock and automation

The premium version of our Warehouse Building Stock Database for Q2 2023 demonstrates just how far ahead Amazon is in terms of warehouse stock. Our in-depth analysis of almost 17,000 warehouses in UK, France, Germany, Italy, Canada, and the US across 175 retail companies shows Amazon has the largest number of warehouses (more than 1,500 across the six countries), followed by Walmart (which has 80% fewer warehouses than its rival), and Target.

However, it is interesting to note Amazon scored lower than a number of other retailers in the study, for example 14x lower than Adidas for expected automation investment per warehouse between 2023 and 2025. This is in large part because of Amazon’s huge warehouse footprint and also an anticipated slowdown in automation spending by the e-commerce colossus. In contrast, Walmart’s contracts with Symbiotic for its food distribution facilities and Knapp for e-commerce is expected to help drive up automation revenues over the coming years.

Looking to 2023-2025, behind Amazon, Walmart and Target, companies forecast to spend heavily on automation include Aldi, Adidas, Carrefour, John Lewis and Albertson’s, with the Aldi recently becoming one of the largest global investors in warehouse automation having come late to the game.

Future looking strong for warehouse automation and building

Having seen a significant market correction following the runaway growth of e-commerce during the COVID-19 pandemic, from 2024 warehouse construction and automation investment are forecast to start recovering. It is important to note e-commerce sales are not decreasing compared with their peak during the height of the COVID-19 pandemic, but rather have fallen back as a percentage of overall retail sales. This indicates demand for fulfillment capacity is likely to grow at a similar rate to that seen before 2020, with the move towards just-in-case inventory helping to drive the market, returning automation investment to double-digit growth by 2025.

– Interact Analysis is a CFE Media and Technology content partner.