The J.P. Morgan global manufacturing PMI edged up to 57.8 from 57.1 in January, marking the second-fastest reading ever in the global gauge.

ARC expects the tepid growth seen during 2010 to accelerate in 2011, but remains skeptical about the process automation market reaching pre-recession growth levels.

Promising signs continue to point toward a sustained process automation market recovery to continue through 2011. During 2010, the automation market was at the point where suppliers serving the installed base with MRO activities fared better than those relying heavily on project business. Suppliers ate through a huge chunk of their project backlog and finished product inventory while new projects were postponed or canceled during the recession. Also, shipments for many new project orders received during 2010 were delayed until 2011.

Historically, the process automation market has been characterized by slow yet steady growth, and we expect the market will return to this pattern with an overall CAGR of roughly 6 percent over the five-year period of 2009-2014.

“Suppliers with quick access to raw materials and components and an efficient supply chain to enable quick ramp-up of production and inventory will be in the best position to participate in the increase in demand,” according to senior analyst David Clayton, the principle author of ARC’s “Automation Expenditures for Process Industries Worldwide Outlook”.

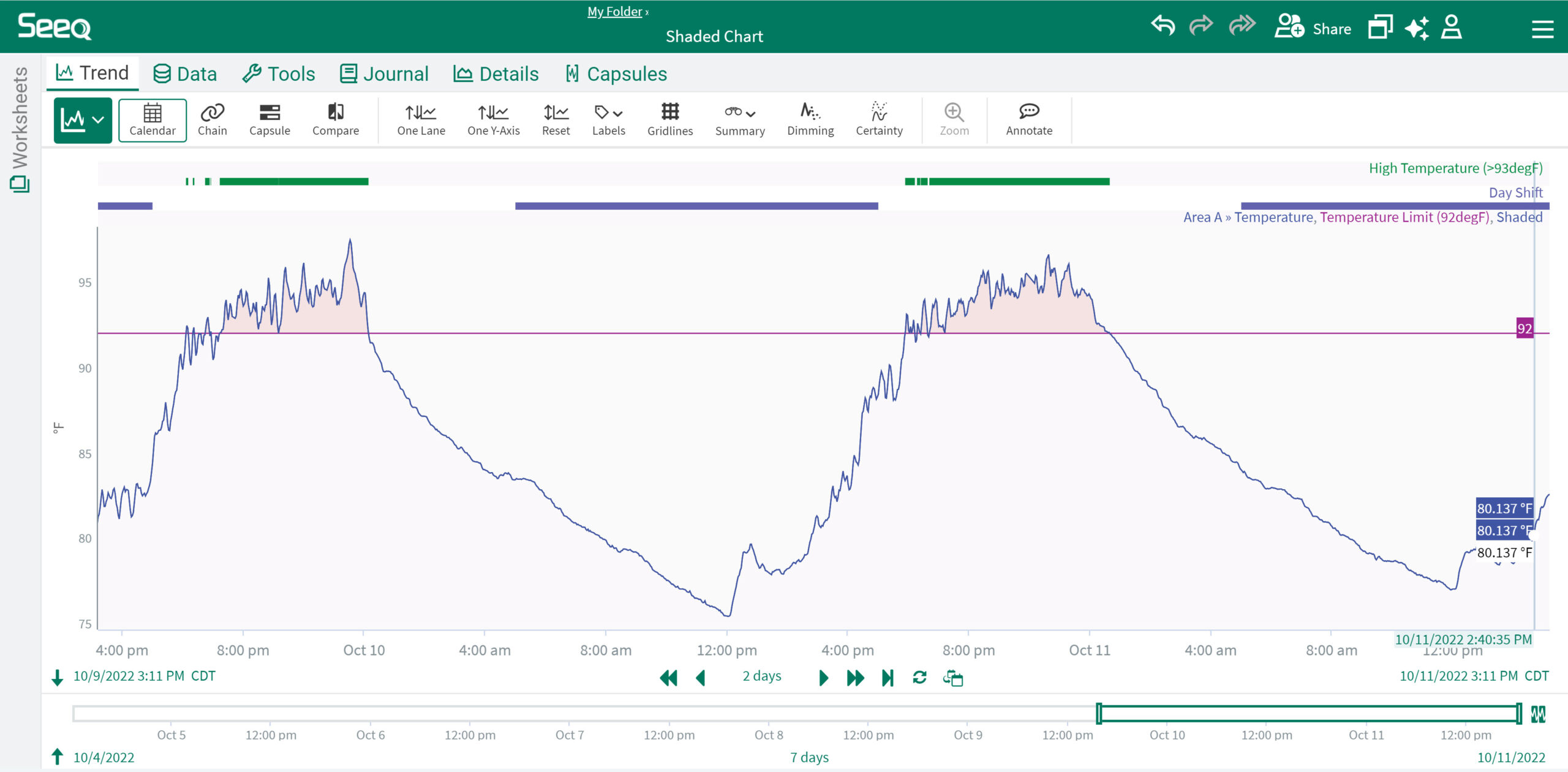

Global Manufacturing PMIs Show Expansion

Purchasing managers’ indexes (PMIs) provide a good barometer of overall health in the manufacturing and automation markets. PMIs typically include data, such as production level, new orders, supplier deliveries, inventories, and employment level. A PMI reading below 50 indicates a general contraction in the manufacturing economy being measured while any reading over 50 indicates expansion.

The J.P. Morgan global manufacturing PMI edged up to 57.8 from 57.1 in January, marking the second-fastest reading ever in the global gauge, which is based on other surveys covering over 7,500 purchasing managers in nearly 30 countries. Output and new order components accelerated, and the input price gauge rose to 76.7 from 73.3 in January. The U.S. ISM represents 28.6 percent of the gauge, followed by Japan at 12.3 percent, China at 7.4 percent, Germany at 5 percent and the U.K. at 4.2 percent.

Plan for Increasing Demand

Most automation suppliers followed a conservative strategy of cutting cost and inventories to match declining demand during the lengthy economic slowdown. Suppliers accustomed to taking risks should put themselves in a position to take advantage of growth opportunities that are taking root in developing countries. Sluggish demand has hurt the bottom lines of sub-suppliers, making them more open to negotiate on both prices and terms.

As the economy recovers, automation suppliers must make plans to make the necessary changes and emerge as stronger organizations that are able to meet renewed demand. However, this confidence will only come if there is a clear understanding in their organizations about the long-term trends that drive demand for automation and develop strategies to satisfy those demands.

Some of these long-term trends include:

- Emerging markets will need to expand their power grids for years to come.

- Mature economies in North America and Europe will have to renew their aging infrastructures.

- Energy efficiency initiatives will be implemented across all areas of industrial organizations.

- Industry must efficiently comply with regulatory agencies without losing productivity.

- Most countries must tackle climate change before the emissions from the growing use of fossil fuels stifles progress, an issue that is plaguing China.

- The intense competition of global markets will continue to drive industry to become more efficient.

- Many of the easy gains have already been realized by industry, so now they will look for new ways to raise productivity.

- Organizations will require even more information to make optimized business decisions.

- Sustainability will be part of all discussions and implementations

- EH&S requirements will drive new automation investments beyond productivity improvements.

- Discovery and production of new energy sources, such as shale gas, geothermal, and clean coal.

While one can list many more long-term trends, the message is that new strategies must be formed based on these emerging trends, which will impact automation suppliers in a variety of ways, from new product development programs, to establishing added service capabilities, to making regional investments. Satisfying these long-term trends will require producing automation that provides manufacturers with improved productivity, energy efficiencies, optimized processes, real-time data and asset management programs, along with personnel that have a profound understanding of these industrial processes.

Suppliers should limit their exposure and begin identifying preferred sub-suppliers and define a product mix that will be most in demand. Suppliers should plan appropriate inventory based on production and sourcing lead times and demand forecast. The most important step is to carefully analyze end user purchasing history and projected demand. When combined with supply chain and logistics efficiency, it could mean the difference between success and failure. Miscalculations in these areas will hurt profitability; getting it right will allow suppliers to leapfrog the competition.