The last year has been a trying one for many industries, but robotics manufacturers and distributors are using the current climate to develop new and innovative ways for robots to help in manufacturing.

It’s been a challenging year for all industries, even those that experienced a boon during these precarious times. Yet just by its visionary nature alone, the robotics and automation industry is an optimistic one. Innovations on the scale seen in the last decade don’t come from apathy and complacency. The industry is fueled by dreamers and doers, and tempered by pragmatists. Together, their potential is limitless.

So we’re looking ahead. Eyes forward, ears open.

Automation is the great equalizer

Executives from some of the industry’s leading suppliers are optimistic. The CEOs and presidents of ATI Industrial Automation, FANUC America, Harmonic Drive, KUKA Robotics, and SCHUNK weighed in during the Executive Roundtable at Robotics Week 2020. Video recordings from 4 days of educational sessions and keynotes are still available.

The executive panel sees opportunities in medical and pharmaceutical applications, agriculture, and an already booming e-commerce sector that will continue to thrive post-COVID. As a result, the service robots sector is expected to grow at much higher rates than industrial robots. Logistics robots are driving the upward trend with sales projected to reach 259,000 units by 2023, according to an International Federation of Robotics (IFR) report.

One exec reports rising interest from companies outside the automotive space looking to launch massive automation ramp-ups with multi-robot fleets across multiple global locations. Experienced systems integrators will be in demand to help these companies quickly scale.

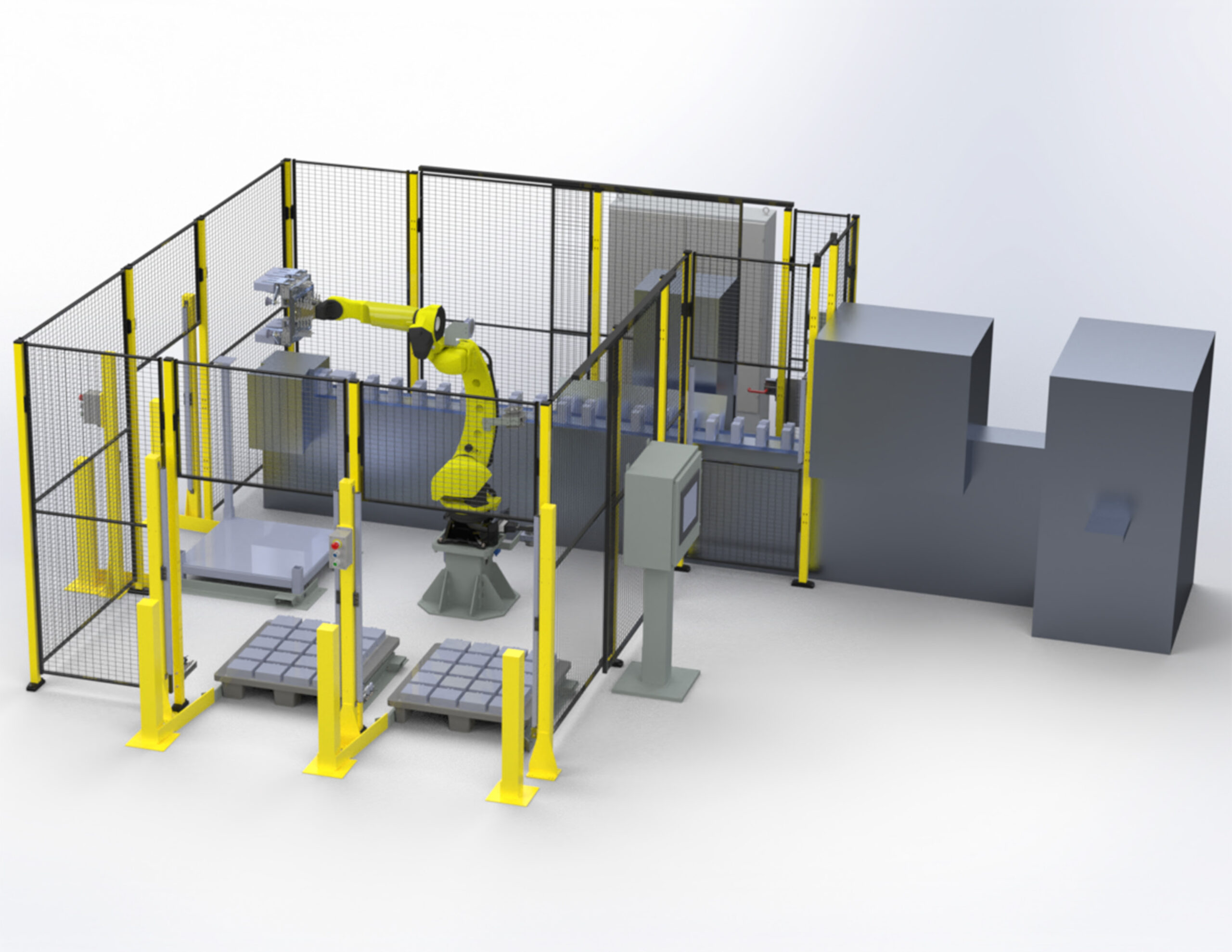

In contrast, the growing number of smaller manufacturers now looking to adopt robotics for the first time will need robots that are easy to set up, program and deploy. Collaborative robots will play a major role in satisfying this demand and collaborative robots are projected to occupy up to 29% of the total market for industrial robots within the next decade. Entire ecosystems are developing around collaborative robots to provide plug-and-play peripherals – grippers, sensors and software – for a turnkey solution to rapid, cost-effective deployment in a variety of applications. Ease of use, scalability and flexibility will be in greater demand going forward.

Reshoring was a hot topic among these thought leaders. It’s been a source of fodder for several years as labor costs rise in traditionally low-wage regions, trade tensions mount, and robotics and automation costs continue to decline.

Global supply chain disruptions due to the pandemic have stoked the reshoring debate. Financial and investment analysts say they are struck by the overwhelming interest in automation and expect it to help offset the costs of reshoring efforts. A Bank of America Global Research report foresees new high-tech, higher-paying jobs, increased innovation, and a positive ripple effect on local economies as these shifts in global supply chains play out over the next decade.

In competitive, fast-paced markets, automation becomes the great equalizer, at home and abroad. Turbocharged by the pandemic, investments in digitalization (employing digital technologies and information to transform business operations for greater productivity and efficiency) are expected to soar. Packed with the right enabling technologies, robots can sense, track and trace anything they encounter and communicate with other automation, providing a bounty of actionable insights.

Follow the money

Whether or not the stock market serves as a barometer for the industry, it’s interesting to dive in, if only for the opportunity to tap the minds of researchers in this space. ROBO Global is an index, advisory and research company based in Dallas. The list of members on their strategic advisory board reads like a Who’s Who of robotics, automation and AI. The ROBO Global Robotics and Automation Index ETF (ROBO), first launched in 2013, invests in global companies that drive transformative innovations in these industry sectors.

“We came to the robotics revolution with the view that this would be the best investment opportunity in a generation,” said Jeremie Capron, director of research at ROBO Global. “The reason being that we’re looking at robotics and machine intelligence, or the AI side, as a set of general-purpose technologies that can be applied to every market, every industry.”

He likens robotics to prior technology revolutions such as the rise of the internet over the past 20 years. The internet became a tool every business in every industry can use in their operations. The same is expected of robotics.

The ROBO index has outpaced global equities since its inception. Even amid the pandemic, the ETF is up 38% in 2020 (as of December 8, 2020).

“We’ve had a compounded average annual return of 19% per year for the past 5 years,” Capron said. “That is nearly double the returns of global equities. The pandemic accelerated a lot of automation and digitalization projects and that’s been very supportive of performance.”

Artificial intelligence and robotics

ROBO Global also launched a more pure-play AI index ETF in 2018 (THNQ), which is up 62% in 2020. It not only targets AI technology companies powering robotics and automation, but also sectors outside of our typical scope such as business process automation software used in human resources and IT departments.

“One of the most exciting areas for us in the last few years has been the machine intelligence side and the providers of that intelligence,” Capron said. “At the chip level, companies like NVIDIA and their graphics processing unit have become the defacto standard for training AI in the cloud, and increasingly at the edge. This has revolutionized the possibilities for automating on the factory floor and elsewhere.”

What’s driving this tremendous growth? “The enabling technologies, from the sensing, the computer processing, the machine intelligence, even the actuation, how the systems interact with the physical world, these technologies are converging right now and they have reached the levels of performance capabilities relative to cost that make all sorts of new automation applications possible,” Capron said. “That’s the overall structural force that’s driving the robotics automation market.”

He said other factors including labor shortages and mass customization also play a role, but they are secondary to the overwhelming converging technology trend driving growth. That’s not the only impact of convergence.

Industrial arms vs. collaborative robots – just robots

Analysts expect to see a blurring of distinctions between conventional industrial robots and their power and force limiting cousins, the collaborative robots.

“The real benefit of collaborative robots is not necessarily that they can collaborate with humans,” said Rian Whitton, senior analyst at global tech market advisory firm ABI Research, headquartered in Oyster Bay, New York. “It’s more that they are easily redeployable and don’t require large-scale external infrastructure investments in order to deploy or install. It’s really that level of flexibility that sets these collaborative robots apart from the industrial robotic arms because their performance is significantly lower when it comes to speed, power and payload. I think gradually you will see a softening of that barrier between those two categories.”

Advances in sensor technology, motion control and machine intelligence combined with evolution in safety regulations will allow the two camps to converge into robots that perform the required work and safely cohabitate in our varied environments.

It’s their mobile counterparts stealing the show.

Mobile robots are major players

While we await roadworthy, fully autonomous vehicles on our streets and highways, autonomous mobile robots (AMRs) for manufacturing and e-commerce fulfillment are taking advantage of some of those advances in self-driving passenger vehicle technology and running full steam ahead. The pandemic has only heightened the demand for mobile robots.

“COVID has made e-commerce the default for many individuals, and even when COVID subsides, this will not revert back,” Whitton said. “As the supply chain sees more demand due to more online purchasing, the challenges of material handling get evermore significant. If we think of the main players in fulfillment, you have e-commerce companies, brick-and-mortar retailers, grocery and convenience store companies, parcel and courier companies, and third-party logistics vendors. All of those are investing heavily in automation and robotics.”

ABI Research predicts mobile robot shipments will overtake traditional industrial robots by 2022 and continue at a higher pace over the next decade. Of the 8 million robots expected to ship in 2030, almost 6 million will be mobile robots, according to an ABI Research report.

In the chart, the mobile robots category includes all types of robots with mobility regardless of the mode of locomotion or the end-use, including AMRs, robotic forklifts/tuggers, bipeds and quadrupeds, cleaning robots both professional and consumer, and delivery robots, among many other varieties for different industrial, professional and consumer markets.

Logistics, e-commerce

Whitton used the forklift market as an example. “Close to a million forklifts are sold every year, which is a huge opportunity if you automate. Of all the forklifts sold each year, less than 1% are automated. All the major OEMs like Toyota, KION, Mitsubishi, Crown, Hyster-Yale, they are all on board and have their own robotics projects and are partnering with robotics vendors. We think the automated forklift market has real opportunity.”

ABI Research forecasts shipments of automated forklifts to grow from about 1,000 in 2020 to 156,000 in 2030.

Cleaning and disinfection

Beyond manufacturing, warehousing and fulfillment operations, other areas of promise for mobile robotics include commercial cleaning robots. COVID-19 has given rise to the importance of ultraviolet (UV) disinfection robots.

Henrik Christensen, director of the Contextual Robotics Institute and Professor of Computer Science and Engineering at University of California San Diego, was one of the esteemed keynote speakers during Robotics Week. Christensen gave a preview of the latest edition of the U.S. Robotics Roadmap published this past September. He discusses the market potential, challenges and enabling technologies for robots in a variety of applications, including manufacturing, logistics, transportation, agriculture, healthcare and security.

Christensen said if someone had asked him if there was a market for disinfection robots, even a year ago, he probably would have said no. Now he’s predicting an enormous growth in this area. As the world attempts to return to some normalcy and avoid the spread of infectious diseases in the future, we will see more disinfection robots in airports, hospitals, schools, cruise ships and grocery stores, among other highly populated public spaces.

Also, watch for large, commercial autonomous floor scrubbers to begin popping up in more places.

Data collection and inspection

Data collection and inspection is another growth area for mobile robotics. “Robots deployed in industrial environments to automate vision inspection of industrial sites like oil rigs, chemical plants or mines, I think you will see a lot more of those systems deployed,” Whitton said. “They won’t necessarily be entirely autonomous, but they will be teleoperated by people far from the scene.”

Underwater robots, aerial drones and all-terrain ROVs used in oil & gas and the greater energy sector fit that bill.

Indoor drones, flying data collectors

For the next big thing in robotics, Capron suggests we “look up!” That’s not just any flying robot; this indoor variety can count.

“In recent years we’ve seen good penetration by drones in niche markets developed around inspection outdoors, things like wind turbines, or infrastructure, electric transmission lines, or the mining industry using drones for surveying. But right now, the real interesting development is happening indoors. In the use of small, autonomous drone systems for manufacturing and warehouses, where the drones are autonomously scanning bar codes for inventory management.”

He provides an example. DSV is a large logistics company that partnered with autonomous indoor drone developer Verity to manage inventory. According to DSV, during a pilot program in a warehouse in the Netherlands, the drone system completed thousands of autonomous flights and tens of thousands of barcode scans. Without human interaction, the system can detect if pallet positions are empty or occupied. The drones often operated at night as not to interrupt warehouse operations.

After these indoor drone systems go commercial, Capron said many others will likely follow suit. In a manufacturing world looking to digitalize at every turn, keep your eye on the drone.

China, China, China

China is a trend all on its own. There’s no question the country will continue to play a major role in the robotics and automation arena. China is already the largest market for industrial robots, and the goal is self-sufficiency.

“Currently, China may build the base platform for industrial robots in China, but they rely on outside suppliers, especially from Japanese companies like Harmonic Drive and Nabtesco, for the actuators and the drives themselves,” Whitton said. “China is trying to build that in-house capability, as part of its drive to dominate and compete in high-technology sectors.

“For every robot that gets deployed or innovated in the U.S. or Europe, you soon find an analogous company developing something similar in China, even for the very sophisticated and complex systems like the quadrupeds. China has historically been very good at imitating, but as the success of companies like (consumer drone maker) DJI has shown, they are increasingly outcompeting Western companies on reliability, price point and user popularity.”

He expects we’ll see more Chinese companies developing industrial robotics, going forward.

Capron said China and other emerging markets are still playing catchup with the Western world in terms of automation intensity. Although China shows the most growth in robot installations, the country still lags behind other Asian and European countries in robot density, or the number of industrial robot installations per 10,000 manufacturing industry workers.

“Just China catching up to Western and Japanese standards is a major source of volume growth for the next decade,” Capron said. “Thailand, Vietnam, Philippines and Indonesia also have long runways for catching up with the intensity of using automation equipment. That’s a big part of the growth story in robotics automation globally.”

Robotics in medical, life science and pharma

Medical applications represent another rapid growth sector. Intuitive Surgical, maker of the world-renowned da Vinci surgical system for robotic-assisted minimally invasive surgery, is an original member of the ROBO index. Now, millions of procedures later, the surgical robotics market is expanding with new possibilities and new players.

“We’re still barely scratching the surface with robotics in surgery,” Capron said. “There are so many procedures where we will be able to use robotics to increase accuracy, speed and improve patient outcomes.”

Robotic-assisted prostate and gynecologic surgeries are already common. Robotic surgery has also moved into orthopedics, starting with spinal procedures and now knee, elbow and shoulder replacement.

The market potential in the medical field is multifaceted. Beyond surgical, there are high expectations for lab automation, where robots are handling biosamples and tending lab machines and equipment.

Capron said genomics has been a game-changer. “Because genomics requires a much higher level of automation than traditional lab processes, you have companies like Brooks Automation that have positioned themselves very well through acquisitions to serve the biopharma industry. They have end-to-end comprehensive automation solutions for the management of biosamples from collection to storage, to retrieval. You have companies like Omnicell that provide automated pharmacies, like the central pharmacy in a hospital.

“The big story in life science and the healthcare industry is genomics because the cost of genomic analysis has plummeted almost exponentially. It’s reached a level where you can use genomics in so many aspects of healthcare. In the detection of diseases like cancer and then in cancer care itself. We have the gene-editing technology (CRISPR) that has been recently approved by the FDA. There’s a huge demand for genomic analysis, which requires a ton of lab automation. There is more demand than supply right now.”

Whether it’s about toilet paper or PPE, more demand than supply has been the story of 2020. Robots help us bridge that gap. They empower higher productivity, greater efficiencies and a better quality of life. There’s no doubt the pandemic shined a bright spotlight on the merits of robotics and automation, and maybe even shifted some mindsets along the way. Remembering what we do and why might be the shot in the arm the industry needed.

Tanya M. Anandan is contributing editor for the Robotic Industries Association (RIA) and Robotics Online. RIA is a not-for-profit trade association dedicated to improving the regional, national, and global competitiveness of the North American manufacturing and service sectors through robotics and related automation. This article originally appeared on the RIA website. The RIA is a part of the Association for Advancing Automation (A3), a CFE Media content partner. Edited by Chris Vavra, web content manager, Control Engineering, CFE Media and Technology, [email protected].