Overview of an evolving telecommunications landscape

Telecommunications in oil & gas

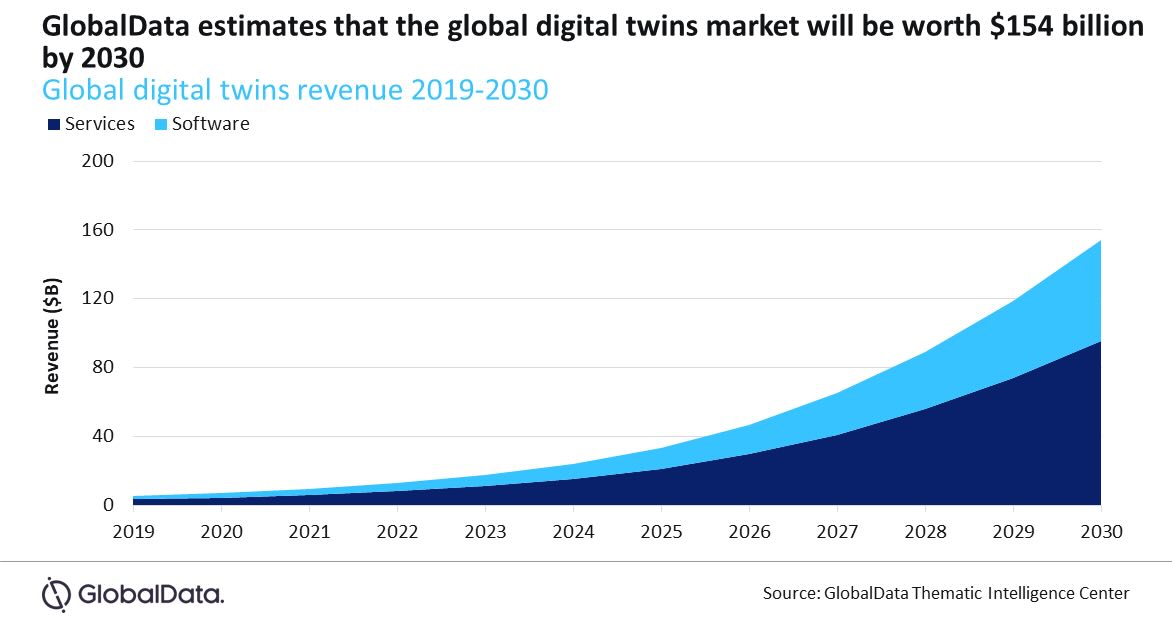

According to McKinsey, the use of advanced connectivity to optimize oil & gas drilling and production throughput, and improve maintenance and field operations, could add up to $250 billion of value to upstream operations by 2030.

Key to the industry’s journey to digitalization is last-mile or wireless connectivity. In fact, upstream, midstream and downstream oil & gas sectors are increasingly looking to private 4G and 5G networks as the standard for more advanced wireless data transmission to drive efficient operations, provide workforce safety and enhance environmental sustainability.

In a recent CFE Media webcast, Ericsson and Tampnet described use cases they see in the oil & gas industry. Ericsson is a market leader in global 4G and 5G network infrastructure. Tampnet runs the largest offshore high-capacity communications network in the world, serving companies in oil & gas and other industries.

Below please find a selection of the questions answered in the webcast, as well as answers to some questions the presenters didn’t get to. The presenters were Viren Parikh, director of business Development, Ericsson, and Frode Støldal, chief digital officer, Tampnet. The webcast in its entirety is available for viewing in the CFE Media archive broadcasts.

Why can’t we just use WiFi? What is main differences between Wi-Fi and LTE?

Wi-Fi will always be around; it is one of the most ubiquitous wireless connectivity choices our society has. But, WiFi is also same technology used in our homes and has limitations when it comes to certain industrial uses like range, ability to handle many simultaneous connections, seamless mobility, SLAs, and security. As your network needs expand, Wi-Fi becomes a bottleneck in any of or all of these aspects. That’s when it starts making more sense to start looking at LTE and 5G.

A quick example, imagine covering 2-3 square miles of territory. Imagine having to do that with WiFi access points, you might need as many as 100, whereas with LTE/5G, you may need no more than 6-10 to cover the same area.

What is CBRS spectrum? How could an oil and gas company use it?

CBRS spectrum is FCC spectrum that the FCC many years ago dubbed the Innovation Band. It is spectrum that any industry, operator, or user can use, similar to Wi-Fi, but also lightly coordinated by database entities called SASs. These SASs communicate to make sure there is some amount of coordination between different CBRS radio nodes within the band per a given location. It’s meant to really allow all sorts of industries, like Industry 4.0, to really have ability to quickly and cost effectively deploy WAN networks to meet their unique business needs. There is a section of spectrum called GAA (generally authorized access), which can be used by an entity like an oil & gas company. There are no fees associated with using it, other than the connectivity to the SAS provider for their coordination services.

What differentiates use of private networks in industrial environments as opposed to commercial environments?

It depends on the use case for the particular enterprise. Some enterprises don’t want certain types of data to go outside of their facilities, others may have stringent latency requirements. Still others may be challenged by existing commercial coverage. All these are reasons, among many others, that an enterprise would want to consider private networks. These LTE/5G based networks are a bit more complex to operate than traditional IT networks. An enterprise may still choose to partner with a traditional commercial wireless operator to help them with running the local LTE/5G private network. Some may choose to do it themselves. The sharing agreement between the enterprise and a commercial operator can range widely. At Ericsson we’re here to help enterprises decipher those choices and weigh the pros and cons.

Who in most companies has direct responsibility for keeping the network going?

So far, our experience has been that the IT organizations are responsible for these decisions within oil & gas facilities. But the consideration goes beyond just traditional IT equipment. Some of these use cases really open up other capabilities on the OT side of the business. Our suggestion is that both IT and OT should be involved in evaluating the business case and strategizing about whether LTE/5G based private networks is right for their overall company and the future direction.

Are there suppliers working toward a single solution for a 4.0 ecosystem rather than having to coordinate with so many different suppliers?

At Ericsson, we have been able to work with various ecosystem partners, starting with the operators and the enterprises, to device makers and gateway providers, to finally system integrators. It can be daunting at times, but one should keep in mind that at Ericsson, it’s been done before quite many times, and can be done again with right partnerships and understanding.

With so much equipment in the field how can companies manage the scale and scope of condition-monitoring applications?

This is one of the benefits of LTE/5G based networks. For one, it handles a multitude of connections, including sensors, tablets, cameras and others. The next question is how to manage [the connections]. Available platforms range from the device vendor’s own management system to more centralized monitoring application solutions like the one Ericsson and Tampnet offer called IOT Accelerator. This allows organizations to track every LTE/5G based device in their network, and monitor it’s usage, up/down time, status, and other KPIs related to those devices. The beauty of this service is that it doesn’t have to be just on Tampnet’s network, it can be any network around the world that Tampnet can reach due to their global roaming agreements.

How important will the intersection of private networks and edge computing wind up being? Are there technology developments coming that will make edge computing even more pervasive?

A private network, that is wholly and completely located on-premises, is already considered ready for edge computing (assuming the edge resources are also co-located on premises). With more applications that require higher peak speeds and lower latency to open up new applications in industries, we’ll see more and more use of private networks as an enabler to edge computing.

Today, some applications that could possibly benefit from edge compute would be drone-based and AGV-based applications that take input like images, or videos, and need to make decisions quickly and take light actions. These are prime candidates for private networks with edge compute.