Decision support platform captures real-time data and delivers operational intelligence.

Rotating equipment, like pumps and compressors, are the heart of the circulatory system for oil & gas companies, and in particular, midstream. It drives millions of barrels of liquids and billions of cubic feet per day through millions of miles of pipelines and associated storage facilities.

Rotating equipment is also often at the root, thanks to the laws of physics, of equipment failures, associated repair costs and lost capacity. But without a healthy and efficient rotating equipment capability, no midstream system can perform well, if at all, due to commercial, safety and environmental implications.

The dilemma is further compounded by:

- A wide disparity in types, makes, models, and vantages

- Remote operations with limited or no connectivity

- A wide range of the level of sensors from minimal to rich coverage

- Limited historical use of analytics and digital support systems

- The seemingly sudden nature of failures spread over a vast territory.

Given these challenges, how are leading midstream O&G companies leveraging modern digital technologies, including advanced analytics, to transform from a reactive, run-to-failure strategy to a proactive, advanced conditioned-based operational decision support and maintenance strategy?

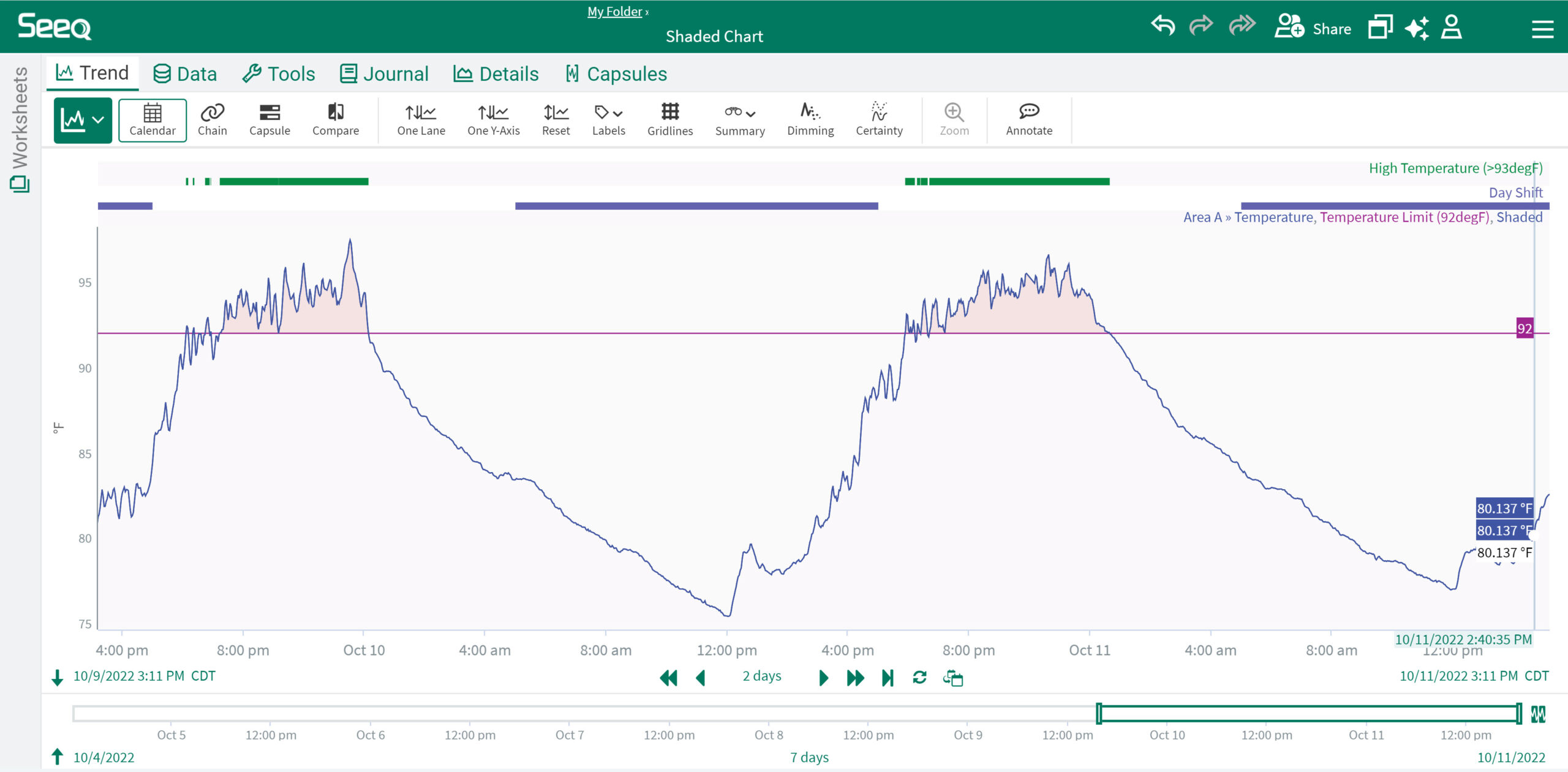

First, these leading companies are leveraging an agnostic decision support platform (DSP) as the foundation that captures data in real-time and serves it up in operational intelligence to central control rooms, distributed operations and maintenance personnel. A key element of the DSP is usability: the data needs to be turned into contextualized operational intelligence, i.e., functional digital twins that individuals can interpret, use and understand. These digital twin templates also have associated visualization templates that streamline both the development and use of smart, configurable displays.

Case examples

A large North American natural gas transmission and storage company, for instance, has over 825 compression units in 245 stations consisting of turbine, reciprocating and electric drives with vintages from pre 1970s to 2010 containing over 165 different makes and models. Their rotating equipment SMEs, with minimal training and mentoring, were able to configure a portfolio of digital twin templates that were used to perform descriptive-, diagnostic-, formulaic- and empirical-based predictive analytics. They also developed templates for the common types of anomalies. (See Figure 1)

From an end-user visualization, they developed screen templates that leveraged the underlying digital twins to simplify both the navigation and operational intelligence presentation and also manageability.

Similarly, DCP Midstream, one of the largest natural gas gathering and processing companies in North America with 60+ gas plants, 11 fractionation plants and 2000+ compression units in 400 compression stations supporting over 57,000 miles of pipelines in six states, launched an effort in 2016 to wring efficiencies out of its operations with digital technologies while empowering and enabling employees the ability to act intelligently on the spot to market demands or company needs.

DCP empowered their rotating equipment engineers to configure digital twin templates for the diverse fleet to provide real-time condition-based decision support and advanced conditioned based maintenance. To address the remote sites with older rotating equipment lacking the necessary sensory data, DCP Midstream leveraged IIoT with wireless sensors integrated to a cloud-enabled head that streamed data to a third-party cloud based advanced analytics solution. These systems provide secure connectivity to remote sites.

To prevent “IIoT hell” from impendent IIoT data locations, DCP brought the cloud-based data and associated analytical results back into their digital decision support platform and integrated it with other analytics and visualization.

How did it work? DCP says it has added $40 million EBITDA to its finances in two years through increased productivity and reduced maintenance. The initial investment ─ mostly centered on new facilities and employee training and hiring ─ was paid off in the first year. DCP even found it could produce $2,500+ per plant per day; with 60 plants, the potential revenue increase equates to $50 million a year. Accomplishing the same result with traditional means, i.e. capacity expansion, would have cost $350 million, 7x more than the initial investment. DCP says that the effort has also fostered a data driven culture within the company.

Compressors forever

A third example is illustrated by Equitrans Midstream. Covering 41 compression stations with 93 units representing 575 HP supporting 16 gathering facilities and 10 transmission facilities, Equitrans’ rotating equipment SMEs configured digital twin templates for their rotating equipment. These templates included not only advanced equation-based predictive analytics, but also event frames to capture the key information associated with key events such as a shutdown/trip, surge or exit cylinder high temperature. To provide improved event analytics and consumption, they integrated the digital decision support platform and the associated events to both Tibco Spotfire and IBM Maximo EAM.

Rotating equipment is the heart of the O&G midstream industry, and many companies are challenged due to items including rotating equipment diversity, remoteness, lack of sensors, and low historical use of analytics. Leading midstream O&G companies are investing in and leveraging a digitally enabled decision support platform to solve these challenges and provide proactive, advanced decision support and conditioned based maintenance capabilities.

What comes around goes around, and these investments are resulting in transformative business results.