Data from two complementary monitoring technologies enable maximized production rates, even with high entrained solids.

The huge capital amounts required to build new oil & gas production assets, coupled with unpredictable commodity price changes, mean producers focus their attention less on new major projects and more on extracting maximum dollar from existing infrastructure and assets.

While individual oil & gas producers can do little to affect prices received for their products, there are things they can do to reduce costs and maximize production. Whatever the market price, a higher production rate equals more revenue from assets.

Because margins are tight, individual asset integrity can be the difference between incurring a loss and securing a profit. It’s not surprising that producers are shopping among suppliers looking for discounted opportunity crude oils and gas, but this has to be coupled with thrusting operational excellence back to the top of the corporate agenda. All possible options must focus on extracting maximum value from existing resources.

Of course, optimized production must be achieved with investments that deliver fast payback. Substantial reductions or delays in CAPEX projects along with pressure to reduce OPEX mean payback for any outlay must be swift and clear. “Doing more with less,” is the mantra of the moment, and efforts are shifting towards generating maximum return from available resources.

Supplying the missing data

However, maximizing output from existing assets is a major challenge when dealing with incomplete or absent information. Data that can deliver insight and actionable information is needed if operators are to make the right decisions and deliver desired outcomes.

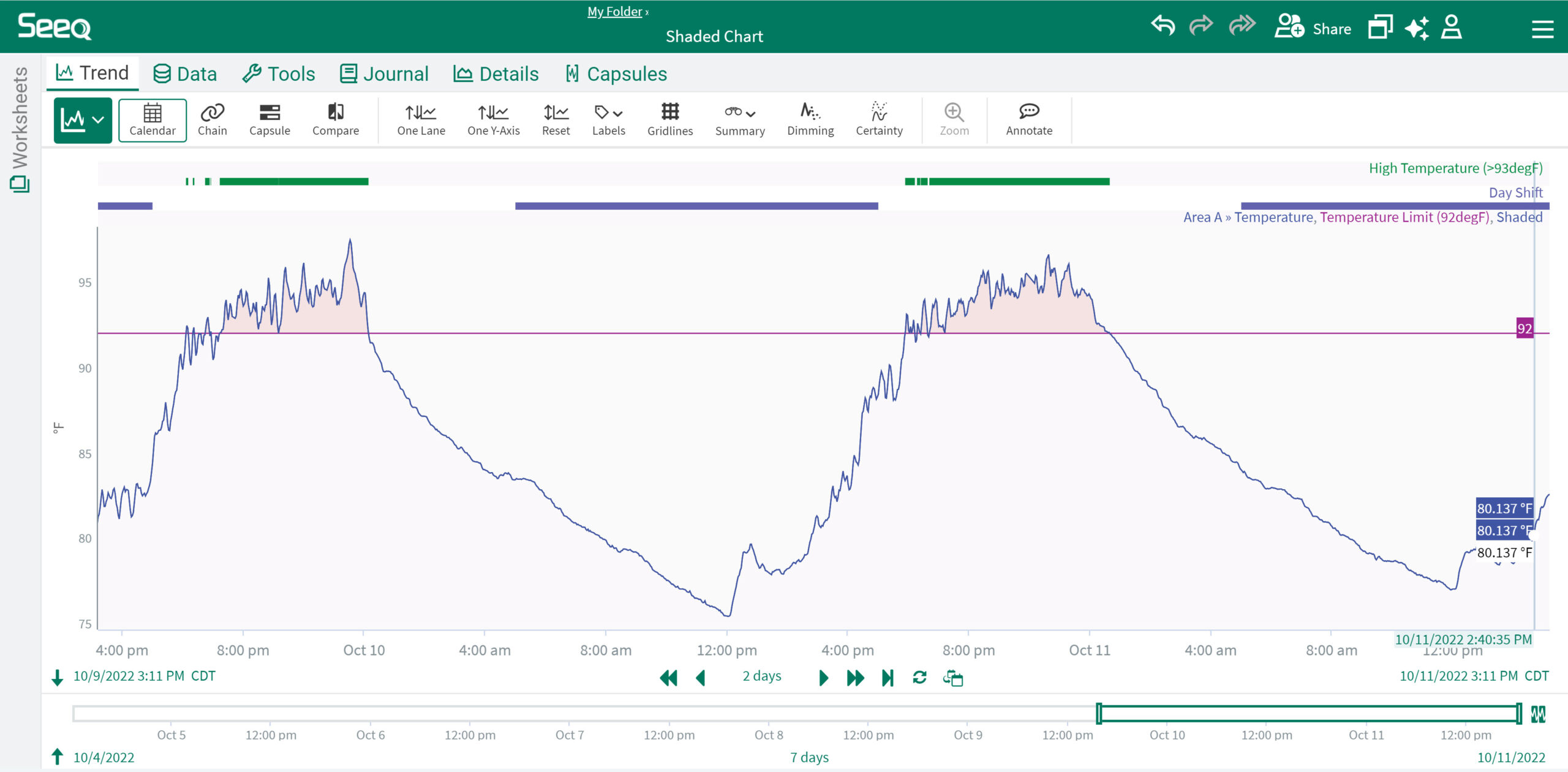

Fixed equipment integrity is one example where cohesive, high-quality and timely data is often lacking. On the one hand, the corrosive effect of produced fluids and the erosive impact of produced sand particles in oil & gas-produced streams is well understood. On the other, information about the impact of these corrosive or erosive materials on actual asset integrity is often absent. The solution is to monitor continuously for corrosion and erosion and use this information to improve operating efficiency (Figure 1).

Sand entrained in oil & gas streams poses significant risk to production equipment because it is moving at high velocities inside fixed equipment and can eat away metal piping and equipment from the inside, with an effect like sand blasting. This erosion occurs inside of piping and equipment, making its effects extremely difficult to detect via exterior inspection. However, modern measurement techniques can detect both entrained sand and its impact on asset integrity.

For best results, operators should seek data regarding sand erosion from a range of sources. In this case, it is best to measure both the risk (sand entrainment rate) and the impact (rate of metal loss). Since sand entrainment in any well is likely to vary over time, it is imperative that both the entrainment and the erosion rate are continuously monitored. Conveniently, measurement techniques for both are non-intrusive.

Listening for trouble

Acoustic sand detectors identify the presence of sand in the production flow by listening for the sound of solid particles hitting the piping’s insides. With careful calibration, the sand entrainment rate can be estimated.

However, acoustic detectors cannot measure the impact of entrained sand on equipment integrity. Established manual inspection methods can intermittently measure pipe wall thickness, but due to the associated costs and safety risks, manual inspections are typically carried out at infrequent intervals, and can require production stoppage. What these solutions can’t do is provide an accurate, complete, and real-time picture of erosion levels.

As a result, operators only have a snapshot of their assets’ integrity at best, and this data quickly becomes out of date. With this minimal information, it is almost impossible to predict whether fixed equipment is good for another five months or another five years. In addition, for a given sand entrainment rate, the erosion rate is expected to be proportional to the cube of flow rate.

Therefore, if sand entrainment is detected, the standard response of the operator is to reduce the production rate, or ‘choke’ the well. Thus, to protect asset integrity and mitigate risk of an infrastructure collapse, conservative production rates are the norm.

Improved asset monitoring

Now imagine the transformational effect of automated sensors permanently attached to strategic points in the infrastructure to take continuous, robust measurements of remaining pipe wall thickness. The sensors use wireless technology to send gathered data for analysis at a central, safe and convenient offshore or onshore location. Operators would gain immediate insight into what’s happening with fixed equipment at any given time, with no need for guesswork (Figure 2).

Data quality improves because monitors are permanently installed with a frequency of measurement allowing operators to see equipment wall thickness changing as it happens. Operators see how the infrastructure responds to unpredictable and generally uncontrollable variables at work. They also see the effect of unexpected changes in temperature, flow rate, or other uncontrolled variables. This allows operators to assess what changes result from higher flow rates, and to understand the effects of erosion mitigation and corrosion inhibition strategies, and then adjust each as necessary for optimum output.

These type tools give operators access to real-time data, enabling optimized operational decision-making and leading to improved asset uptime and increased profitability. These types of high-quality and field-proven solutions make a tangible difference to operator margins by ensuring the plant or asset is nearer maximum capability.

Better monitoring maximizes

One operator with multiple unmanned gas production platforms in the Caribbean Sea used a combination of acoustic detectors to monitor sand entrainment and Emerson Rosemount non-intrusive thickness monitoring sensors to monitor for metal loss (Figure 3).

Figure 4: Wireless sensors were installed as part of a complete data-to-desk system, including powerful data visualization and analytics. Courtesy: Emerson[/caption]

have an especially high level of solid entrainment. An operator in this area had experienced loss of containment issues at several well heads due to erosion caused by sand flows. The operator knew what wells were at elevated risk of solids production but lacked information about how risk varied over time, and whether solids were damaging production equipment.

A solution again used the combination of acoustic detectors and ultrasonic thickness monitoring devices. The solution also included long-range wireless data backhaul to deliver monitoring information from the remote well-heads to a centralized team. The team evaluated the data and made decisions to optimize and maximize production based on solid entrainment flows, all while ensuring wellhead equipment was not being damaged from the inside.

Reduced costs, increased revenue

Using these technologies, operators are in a better position to create a cost-effective program for monitoring asset integrity. There is an instant saving by eliminating the need for frequent routine manual inspections, which can instead be performed by monitoring sensors, especially for offshore assets where cost of access is extreme, and a long-term gain from enhanced asset reliability and availability. Automated monitoring of asset integrity combined with appropriate data analysis also gives operators the confidence to drive their assets harder within the appropriate parameters.

Of course, equipment integrity related to corrosion and erosion is only one element that operators are assessing in the face of lower oil & gas prices. It’s attracting attention, not least because it delivers results within a short timeframe and therefore an equally short payback period, often within days.

It also taps into a wider movement by no means exclusive to oil & gas production. This is the era of digital transformation and technologies that gather, secure, analyze and present data in quick-to-understand formats.

The ability to extract and exploit previously unavailable data is more than simply another cog in the innovation cycle. It is both a solid foundation for future developments and an enabler of long-term, strategic decision-making in the face of an unpredictable and volatile future.