The warehousing automation industry is going through some turbulence, but there is reason for optimism ahead according to an Interact Analysis report.

Global warehousing insights

- The U.S. warehouse automation market has grown due to higher consumer spending and renewed investments by Amazon, improving economic sentiment.

- Declines in the EMEA and APAC regions are driven by economic challenges in the U.K., Germany, and China, impacting consumer spending and investments.

- Warehouse construction forecasts have declined, mainly in Western Europe and APAC, but growth is still expected between 2023 and 2026, albeit slower.

It’s important to describe how the macro-economic environment has changed over the last 6 months, and how this affects warehouse automation investments. For simplicity, we’ll break these down geographically:

-

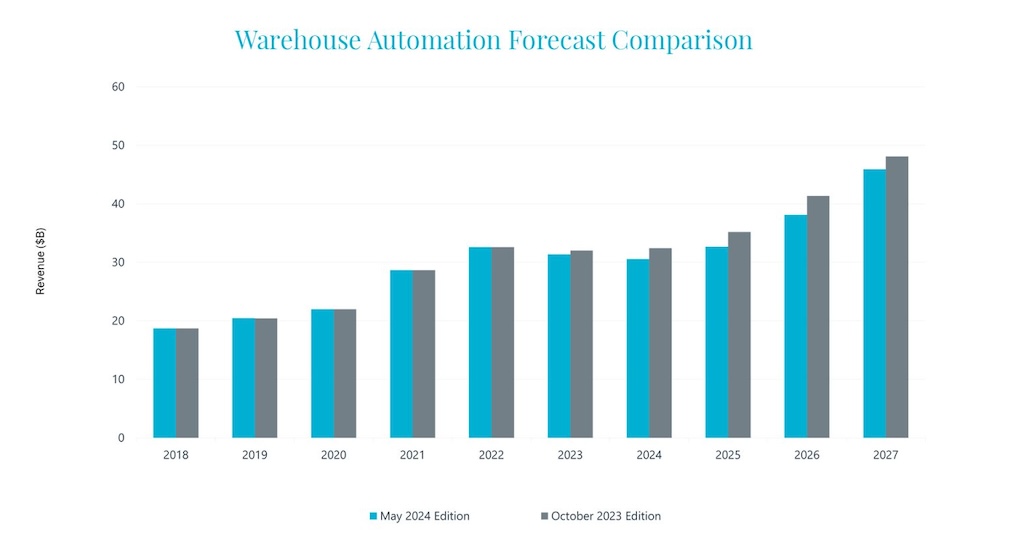

Global: Globally, our market forecast projections for warehouse automation revenue have come down slightly. However, there’s a more nuanced picture when it comes to specific region.

-

Americas: Our warehouse automation revenue forecast projections for the U.S. have increased compared with the November 2023 release. This comes as a result of higher consumer spending, improved sentiment towards the economy, and Amazon starting to invest again.

-

EMEA: Our warehouse automation revenue forecasts for the EMEA region have decreased slightly, although this is driven largely by the U.K. and Germany. We actually see higher revenue growth in Eastern Europe driven by an expected increase in capital investments from manufacturers (both Western European manufacturers off-shoring to Eastern Europe and Chinese producers setting up shop in Europe).

-

APAC: Warehouse automation revenues are expected to contract significantly in APAC, driven by a slowdown in investments from China. The housing crisis in China has led to decline in consumer spending. As a result, we’ve seen e-commerce retailers and express parcel operators pausing their investments, resulting in a fairly significant contraction in investments.

Warehouse construction

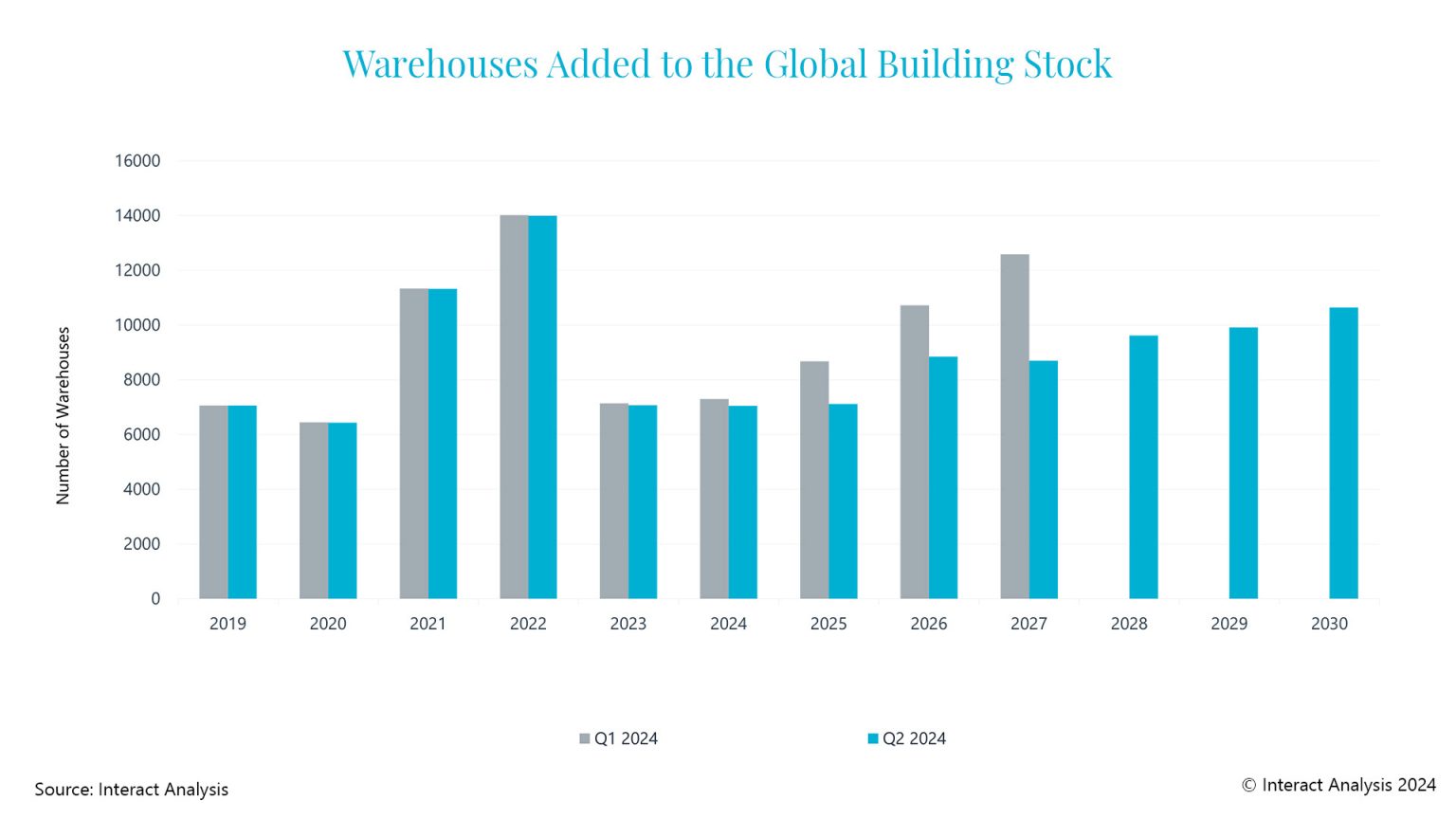

The Q2 2024 Warehouse Building Stock Database release shows that the number of warehouses added to the building stock is expected to decline, relative to our Q1 release. However, this decline is largely limited to Western Europe and APAC, with minimal adjustments made to the U.S. The decline is primarily due to challenging economic conditions in China, and the sustained economic uncertainty in Europe (as a result of geo-political risks and a slower-than-expected climbdown of interest rates).

While the Q2 2024 forecast has declined relative to our Q1 2024 projections, we’re still anticipating growth in actual terms in warehouse construction between 2023 and 2026, albeit at a far slower rate than during the pandemic. Our Warehouse Building Stock Database model partly relies on macro-economic data published by the International Monetary Fund (IMF) to predict future warehouse construction. Specifically, the model looks at GDP, inflation, e-commerce growth rates and unemployment.

Our latest forecast also has an extended forecast horizon, projecting construction out to 2030, which is a major improvement to our earlier releases.

Four warehouse automation insights

In general, our forecasts have remained relatively consistent, with only a slight negative adjustment to the growth rates. Below are the key changes we’ve made to the forecast:

-

We’ve reduced our forecast for China because e-commerce retailers and express parcel operators are slowing down their investments due to weaker consumer spending.

-

Our projections for the U.S. have increased slightly. Vendors at MODEX were cautiously optimistic about 2024. Following the show, we were told that there was a substantial increase in qualified leads, and this is starting to materialize in order intake growth. Furthermore, Amazon is starting to invest more in automation as part of its regionalization strategy. Given that Amazon is often considered a pioneer in the industry, we anticipate others will follow suit.

-

We’ve downgraded our projections in the U.K. and Germany given the worse-than-anticipated economic performance by both countries. We’ve heard from many vendors that investments in the U.K. have been particularly slow this year, and Germany’s manufacturing sector is still struggling. That said, investments in Eastern Europe, particularly in durable manufacturing, have offset the decline to a certain extent. The result is a very slight negative revision to the European market.

-

We’ve made a significant increase to our U.S. grocery forecast, as a result of Symbotic’s higher-than-expected revenue in 2023. We originally expected the company to achieve revenues of $750 million, however it ended up generating just over $1 billion in revenue for the year.

Mobile robot investments

We’ve reduced our mobile robot revenue forecast by $2 billion in 2027, with the projected market size 13% lower than originally predicted. The main drivers for these changes are:

-

Weaker demand and higher pricing pressure in China

-

Longer sales cycle from 3PLs

-

Weaker revenue growth for shelf-to-person autonomous mobile robots (AMRs).

We predict market size in 2027 will be $2 billion lower than previously anticipated

Our forecast for material transport mobile robots is broadly unchanged since the last report as this part of the market is relatively more mature and predictable. On the other hand, order fulfillment AMRs are still an emerging and nascent product, which makes long-term growth harder to predict. However, the industry has now grown to a size where it is no longer immune to the wider economy. Previously, project sizes (and therefore investments) were much smaller, and customer projects were plentiful. This meant the AMR market was in effect too small to be impacted by wider economic performance and could still grow effectively through economic slowdowns. We appear to have now hit the inflection point where this is no longer the case.

Despite the above points, our outlook for the industry is still extremely positive with the underlying drivers of growth remaining strong.

Final thoughts on the warehousing industry

While our forecast updates reflect a slightly more pessimistic outlook, it’s important to recognize the nuance. In many segments, we’re anticipating much higher growth rates than previously thought.

Given the challenging macro-economic environment, it’s more important than ever to identify the high-growth opportunities. As part of our research, we’re always looking to identify emerging opportunities and key threats to the industry.

– Interact Analysis is a content partner.