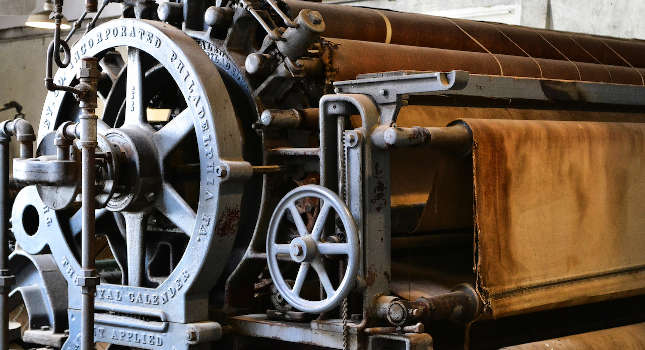

The energy crisis and increasing fuel and raw material prices are triggering stronger demand for geared products used in power generation, which conflicts with following energy conservation and emission reduction acts.

Industrial Gearboxes Insights

- Due to the energy crisis in Europe, industrial gearboxes used within power generation have been the quick fix even though there have been energy conservation and emission reduction acts put into place and in the long run, the gearboxes will have to be upgraded to keep up with energy production.

- Industrial gearboxes are also a good choice for mining and renewable energies, such as with coal-mining plants and wind turbines. However, due to energy tensions, some people have looked at replacing gearboxes with drives, but because of costs the switch can’t be done quickly.

Energy is becoming one of the most prevailing topics to consider when we talk about the manufacturing industry, and so the situation is also impacting the industrial gearboxes and geared motor market. On one hand, the energy crisis and increasing fuel and raw material prices in Europe are triggering stronger demand for geared products used in power generation and related sectors including mining and renewable energy. But on the other hand, energy conservation and emission reduction acts in countries across the world can serve to restrain the expansion of high energy-consuming, heavy industries in short-term at least, while the long-term requires product upgrades of gearboxes and geared motors to help increase overall plant efficiencies.

Price increases driven by rising energy and raw material costs have been the most obvious trend impacting the geared motors and industrial (heavy-duty) gears market, starting in 2021, but continuing in 2022. According to our research this year, prices of geared products rocketed in the first quarter of 2022. Products made in Europe are most heavily affected by energy, while in the US, supply chain issues have been the most important factor pushing prices up. On average it’s expected that gearbox prices will increase by between 5% and 10% in 2022, with further increases also expected in 2023.

High potential for geared products in mining and renewable energies

Coal mining is outperforming in the downstream market for gearboxes since the Russia – Ukraine conflict. The import reduction of Russian fossil fuels created pressure on the global energy supply, especially in Europe. To prevent electricity blackouts, many European countries, such as Germany, the Netherlands and the U.K., decided either to delay the closing of or even restarted coal power plants. As Europe diversifies away from Russian energy, African countries that are not used to exporting coal to Europe have become engaged in this business now. It’s reported that Tanzania, for example, started to export coal to Europe, and its coal production is expected to increase by 50% this year. We expect these dynamics to be reflected in our figures with increasing demand in mining and coal-fired power plants, which are important applications for larger gearboxes with higher torques. During interview, multiple gearbox vendors reported that demand from mining projects are surging, especially in the regions of Europe, South America and the U.S.

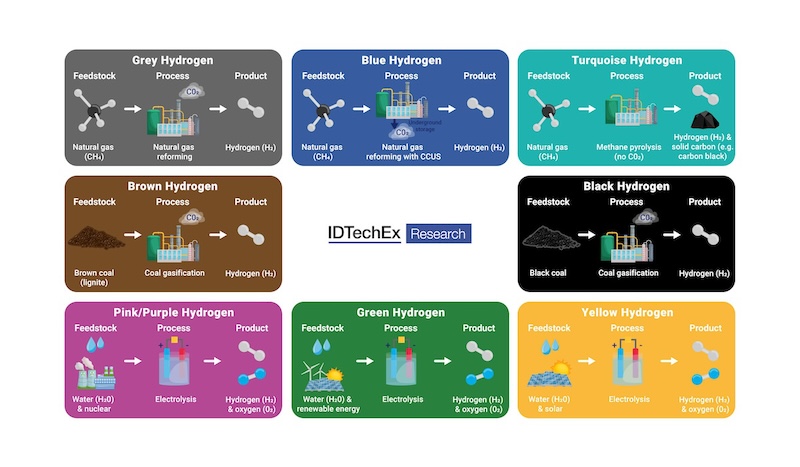

In addition, efforts to move towards renewable energy will open up new markets for gearboxes in the future. Despite the current setback for emission reduction, in the longer-term, the goals remain unchanged for most economies. This will result in investment in clean energy, as well as in related metals, for example, copper and lithium, for energy conversion and storage in sectors like photovoltaics and electrified vehicles. In China, which according to our research was the largest market for Li-ion batteries in 2021, gearbox suppliers have confirmed that demand from the lithium energy sector has indeed ramped-up strongly in recent years, for both light-duty and heavy-duty, high torque geared products used along the production line and throughout the broader lithium supply chain, from mining to battery manufacturing.

Another market with strong potential is the wind sector, which is a market for planetary gearboxes for pitch and yaw applications in wind turbines. According to the Global Wind Energy Council (GWEC), the global wind power capacity in 2021 increased 12%, with newly added offshore wind capacity being three times more than in 2020. Chinese provincial governments have specified goals for wind capacity addition in their five-year plans. The targets sum up to over 70GW per year between 2022-2025, a 47% increase from the 2021 level. In Europe, the installed offshore wind capacity is expected to increase by more than 25 times by 2030.

Short-term challenges for heavy-duty industrial gearboxes

Among the various downstream markets for geared products, for heavy-duty sectors, especially cement and metal industries, which have high pollution and large energy consumption, we have observed some stagnation since the second half of 2021. In China, the world’s largest cement producer, cement production fell 15% in the first half of 2022. In Europe, soaring energy prices are shutting down cement factories in Germany and Spain. Demand for large gearboxes is expected to be affected given these situations.

To comply with the emission regulations of governments and to help reduce their costs, suppliers in the industries mentioned above are paying more attention to energy efficiency, and some are even considering substitutions of geared products, instead moving towards direct drive solutions. Adoptions of direct or semi-direct drives are already observed in belt conveyors and mills. Our research found that there will likely not be a sudden shift from gearboxes to direct drive solutions due to cost reasons. However, the trend is starting to emerge given the energy tension currently, and some suppliers are preparing for it.

Long-term product upgrade towards efficiency

Regarding the motor efficiency of geared motors, there is a clear trend towards higher efficiency classes. In our research, IE3-rated geared motors were reported as the leading segment in revenue for 2020, and the growth rate for this category will be above average this year as major regions, such as the EU, Turkey and China switched to IE3 standards in 2021. Europe will continue to require efficiency updates soon – as of July 2023, most electric motors with a rated output between 75 kW and 200 kW are required to meet the IE4 standard – super premium efficiency. We estimate the market growth for the geared motor with IE3 (and above) efficiency classes to be well above the market average for the foreseeable future.

– Interact Analysis is a CFE Media and Technology content partner.