Growing consumer awareness and changes in standards have forced pet food manufacturers to rethink their processes, products and production facilities.

The US pet food market is booming. In 2018, Americans spent more than $30 billion on food of a total $72 billion spent on pets, according to the American Pet Products Association. Pets are becoming full-fledged members of more and more households.

Concurrently, the food and beverage industry has seen a consumer revolution with customers reading labels, and demanding transparency as well as healthier and more varied offerings from producers. This shift in consumer trends is causing ripples for pet food, too. A growing number of pet owners are trending this way when choosing their pets’ products. From sourcing ingredients to packaging lines, pet food manufacturers are completely rethinking their processes, their products and even their production facilities.

Changing regulations and expectations

While the shift in consumer trends of pet owners is causing many pet food industry changes, an earlier shift first got manufacturers thinking about pet food in more human terms. Many pet food processing facilities began to take a critical look at their operations when the FDA announced the Food Safety and Modernization Act would also regulate pet food.

FSMA’s Preventive Controls for Animal Food rule requires animal food facilities to have a food safety plan in place that includes an analysis of hazards to determine risk-based preventive controls to minimize food safety incidents.

In the last 20 years, many food safety certifications have been developed and updated for animal food manufacturing, including the Food Safety System Certification 22000 and SQF’s FSC32 and FSC34. Even prior to FSMA regulations, pet food processors had a number of reasons to implement food safety standards. Some companies recognized they needed higher efficiency and improved production processes in order to boost their throughput of higher quality and safer pet food. Companies often times incorporated these initiatives into their corporate vision and used them for a competitive advantage.

Also, in the last few decades a number of high-profile pet and human food recalls have loomed large in the public’s mind. These cases not only caused consumers to start losing trust in food and pet food producers, but also spurred retailers to require certain food safety certifications. Some, or possibly all, of these motivating factors began driving the industry to adopt food safety standards well before FSMA announced its animal feed rule.

However, the shift meant operations now had to maintain cleaner facilities and face more inspections from both regulators and retail customers. This required plants to segregate areas and control traffic flow through facilities via sanitary zones based on product contamination risk to minimize food safety incidents.

This has had varied implications for existing manufacturers. Depending on the type and age of the facility, some companies must completely renovate or even build new structures to allow the necessary hygienic environments and offer the cleanability of surfaces required by increased food safety standards. For example, some plants built decades ago are more like warehouses. They’re not designed to withstand extensive sanitary washdowns. New facilities are required to be built with hygienic features, such as stainless-steel surfaces and antimicrobial polyurethane floors. Plus, new ventilation and HVAC features have to be installed in facilities to accommodate proper hygienic air flow throughout the plant floor.

Consumer pet food trends

Then came higher consumer standards. Changing consumer demands affecting food trends is mirrored in the pet food evolution. As food and beverage companies have been changing their product offerings to accommodate different dietary requests and the desire for more varied products using new and exotic ingredients, pet food producers are following suit.

To satisfy picky customers, who may have a picky pet at home, pet food producers are now using dozens of different vegetables and proteins in their products. The variety of meat being used in pet food has moved past ordinary fare of chicken, turkey and beef, and can now contain proteins like emu, ostrich and snake. Even crickets are being used in some recipes for pets that require special diets, and this is requiring pet food producers to widen the depth and breadth of their supply chains.

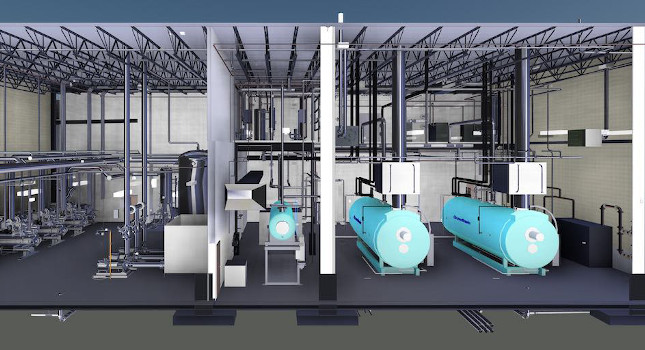

Freshpet’s refrigerated pet food plant features fine-tuned temperature and humidity control.

The current uptick in the pet food trend of “fresh” or never-been-frozen meat and vegetables is shifting the requirements of processors’ food logistics as well as their refrigeration storage area and solutions. When pet food was largely grain-based, there wasn’t a huge need for refrigerated square footage. However, refrigeration is becoming a great need for pet food producers as consumers today want “fresh” options for their pets. Freshpet recently expanded production at an existing facility to meet increased consumer demand. The refrigerated pet food plant leverages fine-tuned temperature and humidity control to maintain product quality.

As the quality of the ingredients used in pet food increases, a surprising result is a rise in the risk of security issues. Some companies using human-grade meat, like sirloin steak, run the risk of theft or shrinkage. A whole new set of security procedures and protocols are now being required for facilities containing these types of costly ingredients.

Another trend in pet food is the raw diet, which consists of meat that has never been cooked. This is one of the more problematic trends since cooking is a microbial kill step and is one of the most common food safety controls. Because these particular pet food products have been the source of recent recalls, processors are looking into using natural preservatives, such as vinegar and smoke. By using these materials, microbial activity can be decreased and shelf-life increased in products processed without cooking.

Vinegar is an acid and will require storage and safety considerations in production facilities depending on the quantities being stored and used. The acid in vinegar is acetic acid, a common chemical in pet food and pet treat plants.

It should be noted smoke additives can be either liquid or powder with the powder version being much more user-friendly. While many pet food processing plants have used and stored acids in their facilities for years, those just now adopting these ingredients will need to carefully consider the safety and building requirements.

WellPet’s new facility leverages freeze-drying to meet demand for raw options.

Other pet food processors are leveraging freeze-dryers to address consumer demand for raw options. WellPet’s pet food processing facility accommodates raw materials receiving and freeze-dried pet food manufacturing. Freeze-drying offers the ability to add shelf-life to any product without utilizing preservatives or additives. While the technology offers several benefits, processors will need to contend with a few drawbacks. The process is not continuous and requires a fairly large footprint, a large capital investment and a large amount of energy to utilize. Things continue to look up for this processing technique though as advancements are made in energy efficiency and manufacturers adopt the technique for specialty high-margin products.

Finally, some pet food companies are looking to new types of processing equipment to satisfy the demands of their customers. High pressure processing (HPP) has been one area the pet food industry has been adopting because the equipment doesn’t use heat, which some consumers think destroys the nutritional content of food.

Modern pet food processing

This combination of changing customer demands as well as increased regulations has brought us to current state of the pet food industry. So how do manufacturers keep up with the rate of change?

A plant’s investment in automation might have started years ago in order to meet FSMA’s requirement of producing, almost instantaneously, food safety documentation and information. This process might have lead to installing track and trace technology, and now if there is a food safety incident, the company can pinpoint exactly where those potentially problematic products are. This means recalls involve fewer products, which means less cost for the company and less chance of an embarrassing and potentially brand-damaging PR event.

This positive experience of having plant floor visibility might have sparked other automation projects, which result in higher efficiencies, better throughput and less unnecessary costs. Having more automated packaging lines means less human involvement at critical points of the production process, which means less risk of contamination and fewer recalls. Also, having fewer humans on the production floor can reduce the risk of worker injuries.

Moreover, with consumers demanding healthier, more varied pet foods, having the flexibility to produce different products with myriad ingredients in a wide variety of packages is increasingly more important for pet food producers. Processors that have more automated equipment that is hygienically designed and incorporates features like clean-in-place can help produce higher quality and allergen-free pet food. Plus, having more operational efficiencies can help cut energy use, which helps the bottom line as well as contributes to a company’s corporate social responsibility efforts.

While consumer trends might change again soon, and it is likely they already are, the bigger trend of people treating pet food similarly to the food they eat is here to stay. Food safety, as well as fresher and healthier pet food, will be in demand for the long haul, so plan accordingly:

- Be proactive in sanitary and hygienic design

- Evaluate refrigeration needs

- Investigate alternative processing methods

- Consider automation to increase efficiency and reduce contamination risks

- Design for flexibility to meet changing demands.

This article originally appeared on CRB’s website. CRB is a CFE Media content partner.