The collaborative robot market, led by China and the United States, is predicted to thrive over the next several years after a difficult period due to the COVID-19 pandemic.

Interact Analysis’ report on the collaborative robot market indicates there is optimism with significant growth predicted over the next decade after a rough 2019 and 2020.

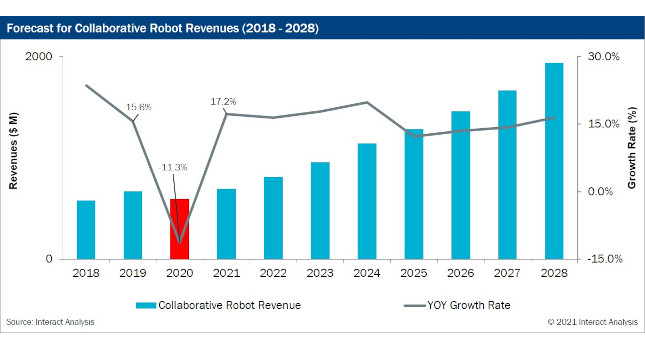

As is the case with many industries, COVID-19 has severely affected the short– and medium-term outlook for the collaborative robot sector. In 2020 the market saw negative growth for the first time -11.3% in revenue terms, and -5.7% in shipment terms. Factory and warehouse closures slowed down demand; and customers became more cautious about investment, leading to delays or even cancellations of orders. Interact Analysis’s research indicates there will be a V-shaped rebound for the industry which will result in growth of nearly 20% in 2021, surpassing 2019 market size.

Thereafter, there will be an annual growth rate of the order of 15 to 20% leading to 2028. The forecast has been lowered compared to the equivalent 2019 report. The main reasons being, besides the COVID effect, competition from small articulated and SCARA robots in industrial settings, and the slower than expected increase in collaborative robot installations in non-industrial applications but, in these turbulent times, the outlook looks good for the sector.

The impact of COVID-19 on the collaborative robot market varies from region to region. The virus started in the Asian regions and then moved to Europe and North America. As a result, normal business operations and commissioning of automation projects in the Asia-Pacific region will resume earlier than in other regions. This is important for the collaborative robot market, as over 50% of collaborative robots were shipped to Asian countries in 2020.

However, only the Chinese and North American markets are forecast to surpass the size of 2019, mainly due to large domestic demand. China has seen high take-up of collaborative robots because the country, as the world’s largest manufacturing base, is suffering from a labour shortage and is in strong need of higher levels of automation to improve production efficiency. By 2022, all regions are predicted to have exceeded the 2019 market-size, with Western Europe, along with China and North America seeing the fastest growth rates.

Jan Zhang, senior director at Interact Analysis, said, “Collaborative robots are still the new kid on the block. Their application potential hasn’t been fully exploited yet, by any means. At present, electronics is by far the biggest end-industry employing cobots, but their potential is now being recognized across a range of sectors. Their flexibility and ease of use makes them strong candidates for logistics, services and even education applications. Our research tells us that those non-manufacturing areas will account for 21.3% of collaborative robot revenues by 2024. Our little Cobot friends are certainly set to enjoy significant growth compared to other robot types.”

– Edited from an Interact Analysis press release by CFE Media.