Companies seek support in knowing what they have and what they need

Results of a recent CFE Media survey, sponsored by engineering corporation M S Benbow & Associates, Metairie, LA, illustrates the changing landscape for instrumentation and control systems in industrial environments.

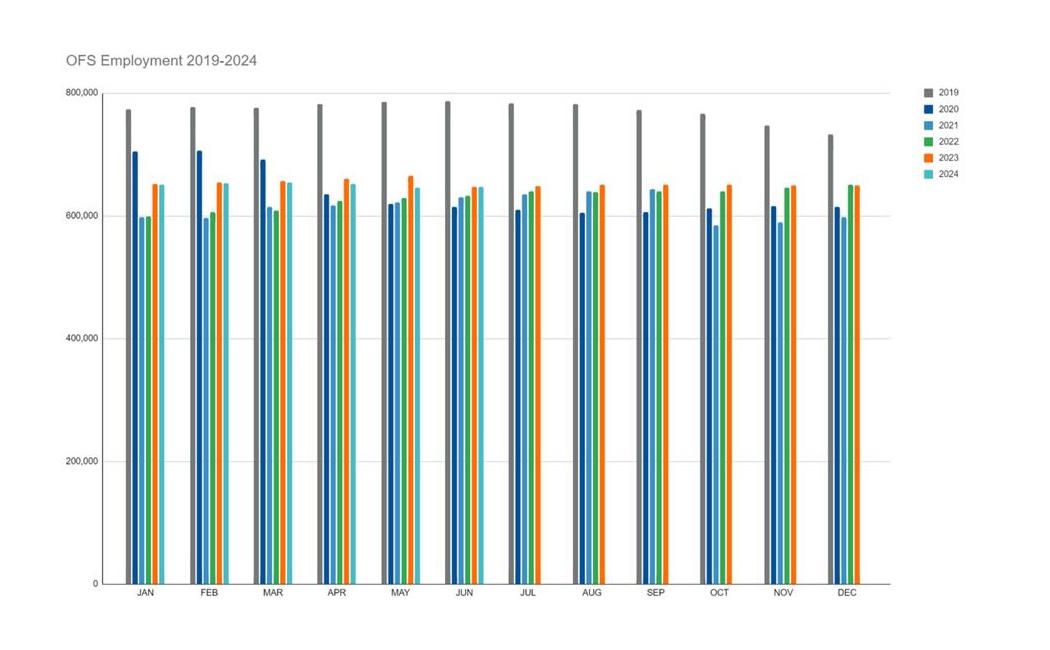

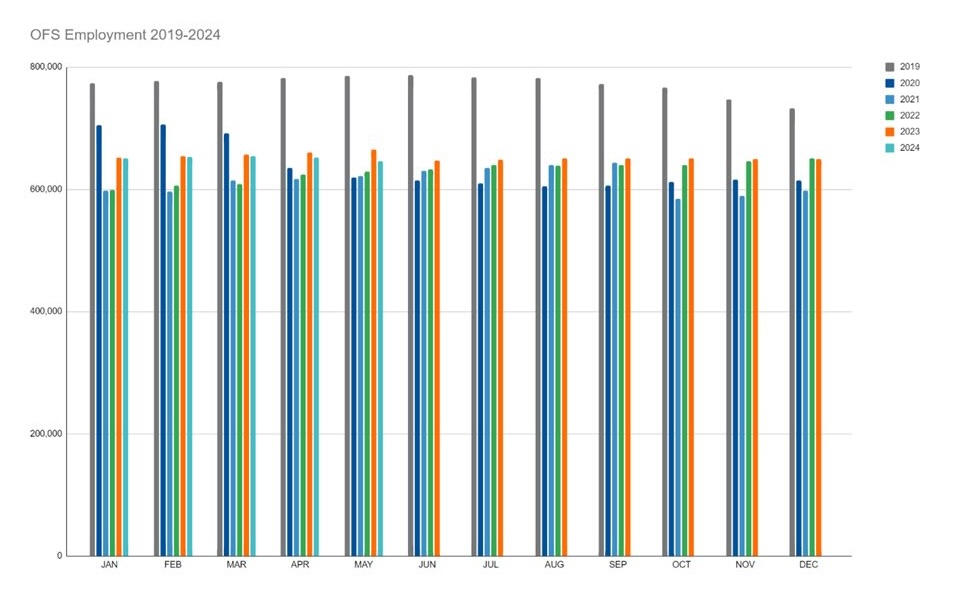

Survey respondents questioned the long-term viability of the installed base of process control and automation systems in chemical manufacturing, oil & gas and other industries.

In fact, nearly 60 percent of respondents from the chemical manufacturing industries expressed concerns about the growing technical obsolescence of these systems. Nearly 50 percent of respondents from the downstream oil & gas industry expressed similar concerns (See figure 1).

At the same time, companies use planned shutdowns to equip their plants for greater access to the data needed to manage their processes.

“What we see are companies performing upgrades as a means to avoid technology obsolescence and to standardize on technologies. All of today’s replacement systems are equipped with network connectivity from the start, allowing more real-time data gathering and analytics use. But the core concerns of operators remain the same,” said Ronnie Ledet, P.E. Program Manager, Instrumentation & Controls, M S Benbow.

M S Benbow supports clients from project conception to completion across a wide range of engineered systems, including process measurement and control, distributed control systems, SCADA and PLCs, analytical measurements and critical safety instrumented systems.

Other topics addressed in the survey included current control system challenges as well as concerns for the future. While optimization and reliability were the respondent’s primary goals, increased networking of machines and equipment, increasingly software-based systems and supply chain reconfigurations are clearly part of their future.

[subhead]Challenges faced

More than 70% of survey respondents from chemical manufacturing industries expressed concerns about control software no longer being supported and 47% expressed similar concerns about PLCs, SCADA and HMIs. Nearly 40% of respondents in the upstream oil & gas sector expressed similar concerns (See figure 2).

“That software continues to be an increasing concern is acknowledgement that automation is migrating away from purpose-built devices to the use of software to deliver more process flexibility,” said Ledet.

In addition, the survey found:

nearly 40% of respondents in all industries surveyed cited concerns about the lack of an accurate blueprint of current systems and software used.

About 40% of respondents expressed concerns that their systems were obsolete given today’s IT-driven advanced control systems.

More than 40% said they saw challenges in their installed base due to lack of standardization in respect to PLCs, control software and HMIs.

[subhead]The road ahead

As would be expected, survey respondents expected any control system replacements to be accomplished by means of a phased migration (29%) or during a scheduled outage or turnaround (32%).

While more than 40% of respondents say they have the in-house resources to plan and execute a migration, nearly the same number will turn to outside support for the following (see Figure 3):

To determine capabilities and technologies needed to reach operating goals (38%)

Develop total cost estimate with feasibility analysis and cost justification (37%)

Facility control system audits to assess current assets (29%)

Keeping up with the latest technology and how to apply it requires a full-time effort. Knowing how to use the hardware, along with the software development tools available, is key,” said Ledet.

Respondents perceive the primary goal of their facility’s efforts as being evergreen:

To increase productivity or optimize production processes (43%)

To increase equipment reliability or product quality (26%)

“The change that’s happened,” said Ledet, “is that facilities are getting their equipment on the network and that doing that is part of today’s upgrades. Clients recognize the need address cyber-security risks. And they’re interested in new ways of achieving mobility and remote operations. Whether that’s labelled as the industrial internet of things (IIoT) or simply greater involvement of the information technology function in operations management is really beside the point.”

Final words

While not strictly a technology issue, respondents across the industry sectors surveyed said one of their biggest concerns is a lack of skilled human resources, with nearly 45% owning up to the challenge.

The two issues, technology resources and human resources, are ultimately related, as shortages of skilled resources seriously impact goods makers. While finding technically qualified workers is a challenge, technology investment is also used by companies as a recruiting tool to attract skilled individuals into the manufacturing and process industries.