The global market for centrifugal pumps is expected to grow to over $40 billion in 2019, but the oil and gas industry's slumping oil prices will carry over to the centrifugal pump market.

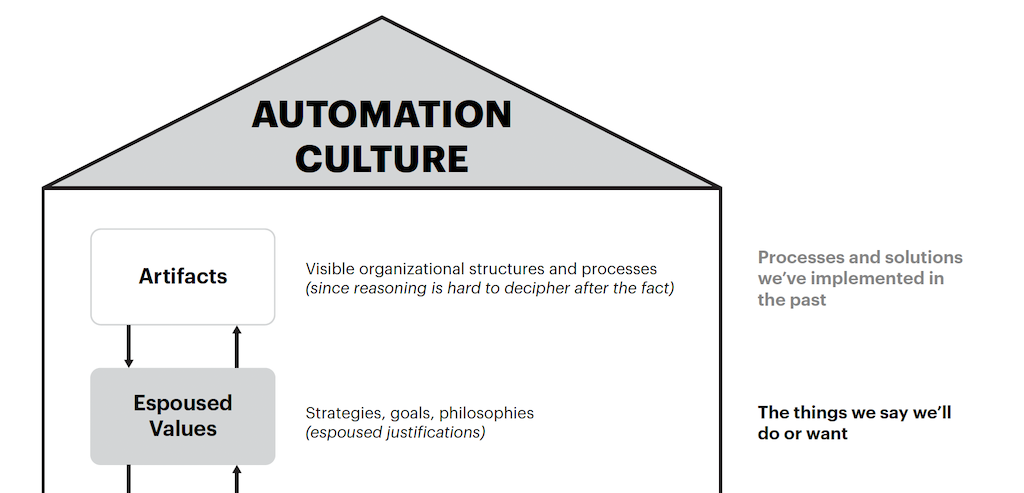

The global market for centrifugal pumps is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2014 to 2019, from $33.2 billion in 2014 to over $40 billion in 2019. The performance of the centrifugal pump market is closely tied to global economic conditions as well as the growth and development of end-user industries. Of the three main regions-the Americas; Europe, the Middle East and Africa (EMEA), and Asia Pacific-EMEA is estimated to have had the largest share of global revenues in 2014 at 46%, followed by Asia Pacific at 34% and the Americas with 20%. In Asia Pacific, China accounted for 60% of 2014 market revenues and was also the largest country in the world in terms of global centrifugal pump sales. Economic difficulties in China and the Eurozone have slowed and will continue to slow pump sales for the global market. The negative impact from the decline of oil and gas prices will continue to perpetuate the global centrifugal pump market’s low growth and even contraction.

Global economic conditions shape the centrifugal pump market

The Eurozone’s sluggish economic recovery will impede industrial investment in the EMEA region. The refugee crisis, coupled with the risk of escalating terrorist attacks, is expected to further erode investor confidence and, in turn, hinder the growth of EMEA’s centrifugal pump market. In Asia Pacific, despite China’s economic slowdown, the urbanization and development of India and the rest of the emerging countries in the Asia-Pacific region are expected to lead to mid- to long-term growth. In the Americas, IHS predicts growth to outpace that of the Asia-Pacific and EMEA markets, with a CAGR of 4.3% from 2014 to 2019. This is because the accelerated growth of the US commercial building sector and increased consumer spending will offset the negative impact of Latin America’s economic recession.

China is forecast to maintain its market-leading position through 2019, with close to $8.4 billion in revenues in that year, comprising 21% of global revenues.

Over the forecast period, the non-industrial and general industry sectors are poised for stable growth despite the economic downturn. For instance, the commercial building, pharmaceutical, chemical, and municipal water and wastewater industries are forecast to outperform the total sector’s average growth during the forecast period. Conversely, heavy industry sectors, such as oil and gas, mining and fossils and nuclear power generation, are forecast to experience below-average growth.

The decline of oil prices has caused turmoil within the oil and gas industry, resulting in significant reductions of capital expenditure. IHS forecasts that the troubled industry will decline the most of any industry in 2015, at a substantially higher rate of -9.4%. The slowdown of this market is expected to continue in 2016. Additionally, the mining industry has been struggling since the end of 2012, with sluggish demand and weakening global prices. Investment in the mining industry will remain low throughout the forecast period. Centrifugal pump revenue in the nuclear power generation industry is expected to decline at a CAGR of 1.5% from 2014 through 2019. Following the Fukushima Daiichi disaster in Japan in 2011, several countries have decided to close nuclear plants and cancel planned ones, despite their role in reducing carbon emissions. At least for the short to midterm, this will drop demand for centrifugal pumps in nuclear power generation.

On the other hand, municipal water and wastewater as well as commercial buildings are forecast to strengthen their positions as the two largest industrial sectors in terms of revenues due to rapid urbanization in emerging markets, accounting for 25.7% ($10.3 billion) and 22.5% ($9.0 billion), respectively, of the global centrifugal pump market in 2019. In addition, the chemical, food and beverage, and pharmaceutical sectors are projected to gain market shares over the forecast period, comprising 5.6%, 3.4% and 2.0% of the total market in 2019, respectively, due to an increase in consumer demand.

– Joanne Goh, analyst for Manufacturing Technology at IHS Inc. IHS is a CFE Media content partner. Edited by Chris Vavra, production editor, CFE Media, [email protected].

ONLINE extra

See related stories from IHS linked below.