The energy and utilities sector has gone through some profound changes, but there is optimism for the future.

It is against a background which may well be the most tumultuous in modern history that I have collated my predictions as to what 2021 has in store for the energy, utilities and resources sector.

On a global scale, despite media attention for the climate crisis being shared with the ongoing pandemic, the charge towards lower carbon emissions within the energy, utilities and resources sector is entering a phase I would describe as characterized by action rather than jargon.

The dangers of climate change have in no way dissipated due to the pandemic’s emergence, and this seems to resonate. Taking a glance across the sector, evidence of an overall forward net movement is present, which while more obvious amongst the more agile businesses in the sector, is also noticeable among the larger, much slower to move monoliths.

Further to this gradual movement, I am observing rapid developments in collaboration, data-driven transparency and audibility, providing the sector with new opportunities to seize market share, win and delight both customers and service users and operate more efficiently from an environmental impact position.

1. Renewables on a charge

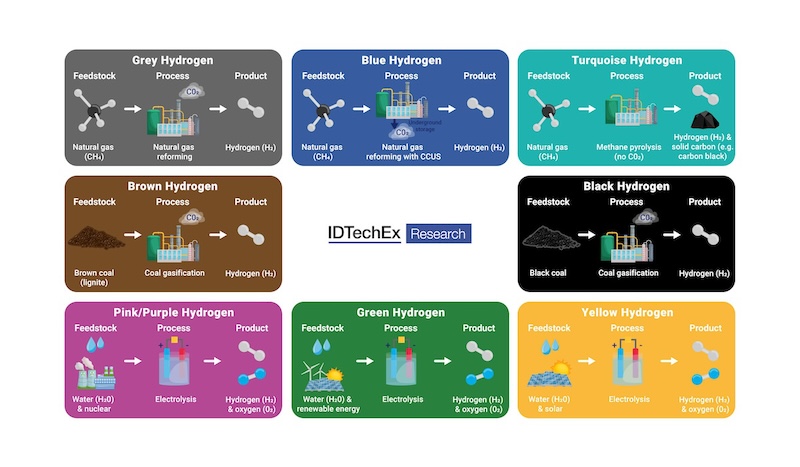

The IEA’s Renewables 2020 report notes that despite 2020 having been a bleak year in many respects, the COVID-19 pandemic has failed to slow the development process of renewable energies. In fact, there is a cause for optimism when looking at the ongoing growth of renewable, green energies such as solar photovoltaic (PV) and wind, as, in terms of new capacity-boosting investments, renewables will continue being the fastest-growing energy source through 2025.

In 2021 and beyond, renewables growth will be fueled by industry-wide, multi-disciplinary joint ventures and partnerships leading to a growing number of major energy and utilities companies joining forces with agile businesses to reach both emission targets and create new, long-term revenues.

There are ample examples across the United States of the process gaining momentum:

- McDonalds USA and APEX Clean Energy have two power purchase agreements for two major wind farms and a large solar projects portfolio across three states. The projects aim to reduce McDonalds’ absolute emissions from its offices and restaurants by 46% by 2030, against a baseline from 2015. Beyond the obvious climate benefit of the agreements, the three new projects will collectively create 135 long-term and 3,400 short-term roles.

- Pacific Gas and Electric Company (PG&E) and Tesla have broken ground on a 182.5 MW lithium-ion battery energy storage system in California to reduce fossil-fuel reliance while paving the way for more renewables in the energy mix. The Tesla Megapack project will result in reduced overall costs for consumers due to a boost in grid efficiency and reliability.

- Walmart Inc. has joined forces with Schneider Electric to provide increased access to renewable energy for the retailer’s U.S.-based suppliers, as part of its goal to become a regenerative company. The Gigaton PPA (GPPA) Program is part of Walmart’s goal to be powered 50% by renewable energy by 2025 and 100% by 2040—currently it powers an estimated 29% of its operation in this way. The program also seeks to educate Walmart suppliers on renewable-energy purchases and encourage the adoption of renewable energy by participating suppliers through aggregate power purchase agreements (PPA).

2. Consumers look to forward-thinking utilities to deliver and service

The result of this trend towards renewables is the proliferation of distributed energy resources (DERs). Over time, industries, as well as private households, are looking to options such as geothermal systems and solar panels to supplement their primary energy supply—more or less sidestepping traditional energy companies.

The consequence of this development is power generation and distribution companies lose a regular and stable revenue source as well as a national or regional grid not designed to accommodate decentralized, renewable energy production.

While this disruption is unwelcome to some, enormous opportunities exist for utilities companies forward-thinking enough to capture emerging revenue streams.

More utilities will likely begin to sell and service DERs, such as solar panels, directly to end consumers. Such products are generally sourced from and serviced by specialist companies, but energy and utilities companies are uniquely placed to leverage their established, far-reaching workforce as well as their economies of scale to offer consumers better payment plans for the up-front costs, timelier service and more choice. Aside from the benefits of trading with a certified, regulated company – and the lower maintenance costs coming from that – consumers would also benefit from a reduction in their energy bills (or actually making money by selling surplus energy back to the grid).

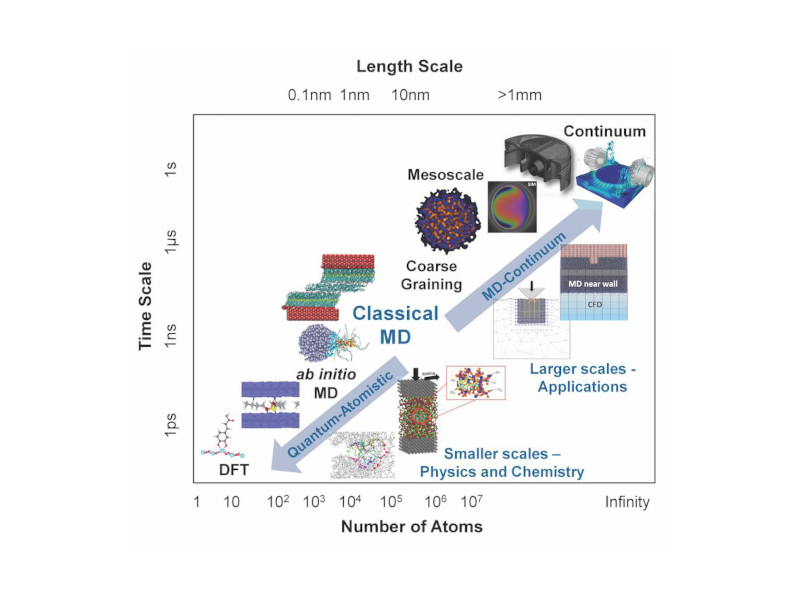

As major utilities deepen their involvement in the DER space, there is a whole new level of pressure to deliver service efficiently and at scale when faced with hundreds of thousands of new, small-scale assets which need servicing and monitoring. Energy companies will therefore need to make a focused effort to implement smart and predictive technologies capable of turning the surge of data into intelligible insights, such as machine learning (ML), artificial intelligence (AI) and digital twins. IDC predicts that by 2025, over 50% of utilities will increase automating operations spend with an emphasis on AI, ML and edge technologies, doubling, as a result, the penetrative capability of predictive and prescriptive maintenance[1].

One of the major challenges market entrants face is finding and deploying a suitable enterprise software which can operationalize unstructured data and turn it into great customer service.

3. The rise of sea power

Operationalizing data can also be turned into great customer service in shipping and cargo.

2020 has been a disruptive year for the global logistics industry, and this disruption is felt nowhere more keenly than in air cargo. In the period between October 12-25, 2020, a report presented by Accenture states, air cargo saw a 20-percent decline in global capacity in comparison to the same period in 2019.

As a result of this trend, we’ll begin to see a flurry of activity within the maritime sector in 2021 as it bids to capture a share of the market from its airborne cousin. Thanks to a ship’s inherent ability to accommodate larger batteries and zero-emission propulsion systems (a feat airplane manufacturers are hard hard-pressed to counter), the sea cargo ecosystem will position themselves as the more sustainable, “greener” option.

As a result of this development, a sort of arms race will emerge among shipping ports to offer more streamlined, intelligent and cost-efficient services to their customers. This new sector dynamic will drive the proliferation of technology such as ML, AI and digital twins as a way of delivering transparency, accountability, traceability and most importantly, a better-quality service experience to the supply-chain.

For the stakeholders and ports which are equipped to accommodate this change, ample opportunity exists for market-share and revenue growth. To succeed, however, will require agile business processes governed by technological infrastructures which is modern, service-centric, and built for purpose.

Next please!

While few will be sad to turn their back on 2020, I believe I see a renewed purpose among those in the energy, utilities and resources sector. In conversations with customers, analysts, partners and other stakeholders, I can also see a broad, genuine desire to deliver on the promises of the last few years. The reason I am convinced the next five to ten years will be an unparalleled period of progress is not only due to it being driven by companies, but by the people themselves.