Traditional petrochemical companies are taking advantage of hydrogen technologies and are investing more in a bid to become more competitive.

Hydrogen production insights

- Traditional petrochemical giants like Shell and TotalEnergies are aggressively investing billions in green energy solutions, including hydrogen, to meet net-zero emissions goals.

- Despite claims of transitioning to green energy, petrochemical giants face scrutiny for potentially “greenwashing” their image while still heavily reliant on fossil fuels.

Governments are becoming increasingly concerned with the transition to greener forms of energy. Under the environmental, social and governance (ESG) evaluation system, the need for traditional petrochemical giants to make this transition has become more urgent.

Among various alternative solutions, hydrogen is becoming a strategic choice for petrochemical giants looking to “go green.” Hydrogen refueling stations (HRS) — a key component of the hydrogen industry value chain — are often the starting point for petrochemical giants entering the hydrogen industry. However, there have been accusations of “greenwashing,” or using hydrogen and other clean energy technologies to enhance their image, while continuing to extract fossil fuels. What does this mean for the future development of the hydrogen refueling station market?

Traditional energy giants accelerate investment in hydrogen energy

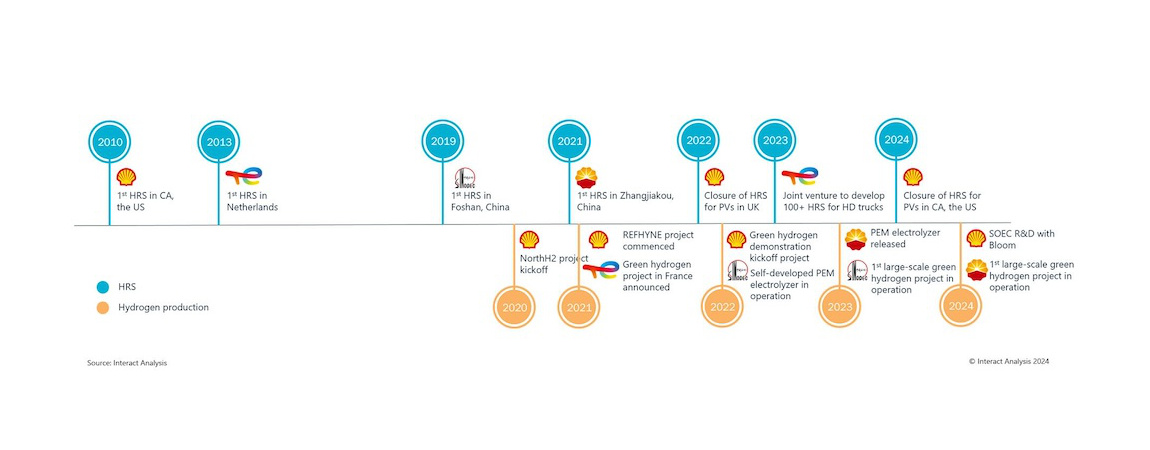

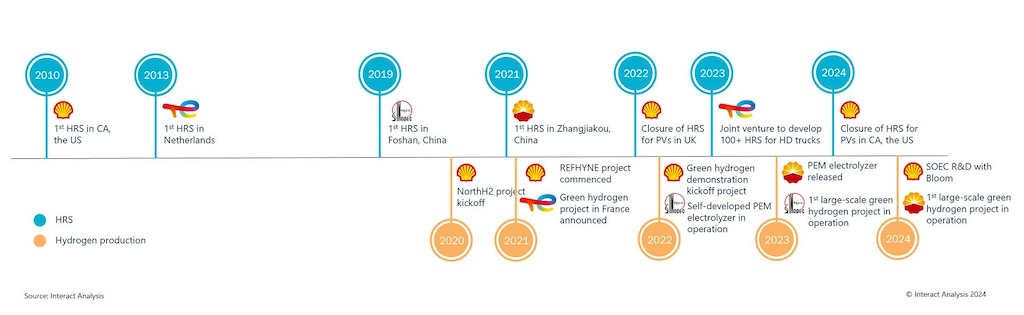

European oil giants started early in the field of hydrogen energy, but only showed signs of accelerating their expansion into the upstream and midstream of the hydrogen industry after 2020. As early as 1999, Shell established Shell Hydrogen, but prior to 2020 its hydrogen business developed slowly and was primarily concentrated on hydrogen refueling stations. With the trend towards carbon neutrality, Shell accelerated its expansion into the upstream and midstream of the hydrogen industry, including production, storage, and transportation.

In 2020, Shell announced its target to become a net-zero emissions energy business by 2050, and in November 2021 stated its business goal of claiming more than 10% of the global hydrogen market by 2035. In March 2024, Shell released “the Energy Transition Strategy 2024”, planning to invest US$10-15 billion in low-carbon energy solutions from 2023 to 2025. These investments will cover electric vehicle charging, biofuels, hydrogen, and carbon capture and storage, etc.

TotalEnergies, another Europe-based energy giant, is also seeking to expand its hydrogen business in order to become a diversified energy company. Since 2013, Total has deployed hydrogen production, transportation and refueling station projects in the Netherlands, France, Germany and Chile. In May 2020, Total announced that it would achieve net-zero emissions by 2050 or earlier. The company then stated in February 2021 that it wanted to become a major producer of clean hydrogen, and in May of the same year the company changed its name to TotalEnergies, adding hydrogen energy elements to its new logo.

Compared with European companies, Chinese energy companies started their transition into the hydrogen business later. Announcements of peak-carbon and carbon neutrality goals in 2020 has clearly strengthened the determination of China’s traditional energy giants to carry out their own transition. In June 2022, PetroChina released the “PetroChina Green and Low-Carbon Development Action Plan 3.0,” which refers to the overall deployment of “clean substitution, strategic succession, and green-oriented transition”, and outlined its transition strategy from strengthening the hydrogen industry chain (2025) to developing a large-scale hydrogen business (2050).

In September of the same year, Sinopec released its mid-to-long-term development strategy for hydrogen energy, proposing the goal of “leading the way with one thousand hydrogen refueling stations, demonstrating million tons of green hydrogen production, in order to reduce carbon emissions by over ten million tons”. The Sinopec strategy document clearly states that it will focus on hydrogen refueling stations and green hydrogen production in order to become China’s largest hydrogen company.

In recent years, the rise in global oil prices has also supported petrochemical giants developing new energy industries, accelerating the deployment of hydrogen energy, and transforming into comprehensive energy companies. However, a 2022 study found that while European petrochemical giants in particular were making the boldest claims about “going green”, they were failing to match their words with action. At a 2022 Congressional hearing in the United States, documents from oil giants ExxonMobil, Shell, BP and Chevron suggested the companies were misleading the public about their commitment to greening their operations.

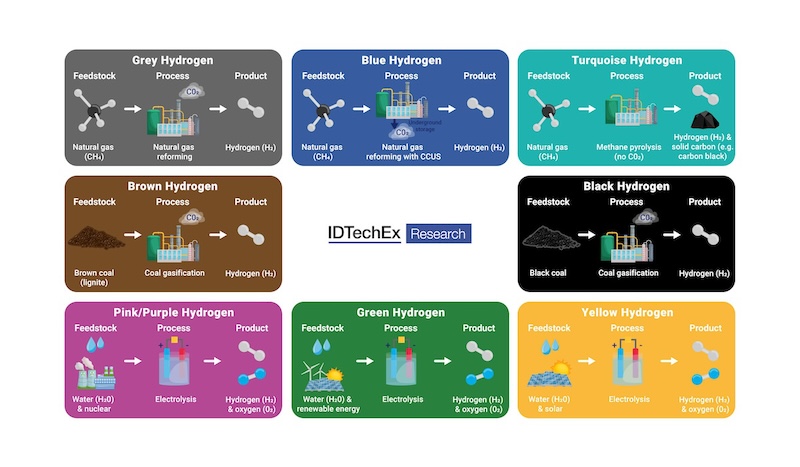

Diversified technologies for green hydrogen production

Upstream hydrogen production is a key area of focus for petrochemical giants’ hydrogen businesses. These petrochemical companies are in a good position to produce hydrogen at a lower cost using existing fossil fuels and refineries. However, with the goal of net-zero emission, petrochemical giants have begun to turn their attention to green hydrogen production, which is more environmentally friendly. Hydrogen production by electrolysis is currently the mainstream means of green hydrogen production, and petrochemical giants are actively exploring and deploying different technologies to gain a competitive advantage in the green hydrogen market.

Shell has participated in the construction of large-scale alkaline (ALK) and proton exchange membrane (PEM) projects for hydrogen production in Germany (REFHYNE), the Netherlands (NorthH2) and other countries. In addition to these two mainstream technologies, Shell is also exploring anion exchange membrane (AEM) and solid oxide electrolysis cell (SOEC) technology through partnership and investment. In March 2024, Shell signed an agreement with Bloom (a US company engaged in fuel cells and electrolyzers) to cooperate in the development of SOEC systems. At the same time, P2H2, a US startup backed by Shell, unveiled industrial-scale AEM.

In addition to outsourcing electrolyzers with different technologies such as ALK and PEM, Sinopec is also promoting self-developed electrolyzer technology – currently focusing on PEM electrolysis. At the end of 2021, the company announced the completion of a PEM electrolyzer (pilot device), which successfully produced hydrogen at Yanshan Petrochemical at the end of 2022. In addition to PEM, Sinopec has also made breakthroughs in SOEC technology. In March 2024, a news release announced that construction had started on a SOEC electrolysis hydrogen production project independently developed by Sinopec.

Development of hydrogen transport ships and pipelines

In terms of hydrogen storage and transportation, TotalEnergies and Shell are both involved in the development of liquid-hydrogen carrier ships. In March 2021, Suiso Frontier, operated by Shell, made her first voyage. In January 2024, approvals in principle were granted to a large liquid-hydrogen carrier vessel that TotalEnergies was involved in developing. In addition to hydrogen carrier ships, in 2022 Shell became the first company to sign an agreement to use the HyTransPortRTM hydrogen pipeline. The pipeline is constructed at Rotterdam Port in the Netherlands and is expected to start operating at the end of 2024 or in early 2025. It will eventually be connected to the Netherlands’ domestic and international hydrogen refueling network.

In April 2023, China’s first “West-to-East Hydrogen Pipeline Corridor” initiative was included in China’s national plan, incentivizing PetroChina and Sinopec’s construction of hydrogen pipeline networks. Sinopec’s hydrogen pipeline business started early, with its first pipeline commencing operation as early as 2014. However, PetroChina has overtaken Sinopec in terms of the number of hydrogen pipeline projects. According to industry news, PetroChina has deployed more than 10 hydrogen pipeline projects across the country. In April 2023, PetroChina announced that it had made a breakthrough in using existing natural gas pipelines to transport hydrogen over long distances, with the hydrogen doping ratio reaching 24%, which could significantly reduce the cost of hydrogen transportation.

Hydrogen refueling stations: Emergence of HRS for commercial vehicles

Petrochemical giants have a strong first-mover advantage in the construction of hydrogen refueling stations. In addition to strong financial capabilities, they also have a mature sales network, which means their existing gas stations can be transformed into multi-fuel energy stations, which greatly reduces the initial construction cost.

Shell is one of the pioneering petrochemical companies to build hydrogen refueling stations. In 2010, Shell’s first HRS started operation in California, USA, and the company has since expanded its HRS network to Europe, Canada, China, and other regions. TotalEnergies built its first public HRS in the Netherlands as early as 2013. PetroChina and Sinopec’s deployment of HRS started in 2019 and 2021 respectively.

Sinopec is one of the leading companies for HRS operation in the world. It has covered major cities in China’s fuel cell demonstration city cluster and other important regions across the country for HRS deployments. Compared with Sinopec’s target of building 1,000 HRS during the 14th Five-Year Plan period (2021-2025), PetroChina appears to have little ambition in this field, announcing plans in 2021 to deploy just 50 HRS nationwide in the future.

China’s hydrogen fuel cell vehicle market is dominated by commercial vehicles and as a result China’s HRS also predominantly serve commercial vehicles, while in other regions HRS are mainly deployed for passenger vehicles. However, it is worth noting that recent developments from TotalEnergies and Shell have shown a clear trend of focus shifting towards HRS for commercial vehicles.

At the beginning of 2023, TotalEnergies and Air Liquide announced plans to establish a joint venture, TEAL Mobility (established in January 2024), aiming to develop more than 100 heavy-duty truck HRS in Europe over the next decade.

Following the announcement it was closing all light-duty vehicle HRS in the UK in October 2022, Shell canceled its plan to build 48 light-duty vehicle HRS in California in September 2023, and announced in February 2024 that it is closing all its light-duty vehicle HRS in California. Meanwhile, in December 2023 Shell announced that it would prioritize its HRS business for heavy-duty vehicles.

Final thoughts

Petrochemical giants have different priorities in their hydrogen energy strategies. As international oil companies, Shell and TotalEnergies focus on global market expansion, and actively seek a leading position in the global hydrogen energy market through investment, R&D and partnership. Chinese leading companies Sinopec and PetroChina focus on improving the hydrogen industry chain and strive to build a comprehensive hydrogen industry value chain in China.

In addition to European and Chinese petrochemical giants, other petrochemical companies such as Saudi Aramco, Chevron, and ExxonMobil also have existing hydrogen businesses or plans to establish them. However, compared with European and Chinese companies that are more active in the hydrogen energy field, these companies appear to be conservative when it comes to their expansion into the hydrogen industry.

It is clear that improving their image and demonstrating their green credentials to consumers also plays a large role in decisions by petrochemical giants to invest in hydrogen energy, in addition to its commercial potential. It will be interesting to see how closely companies’ actions meet their intended goals when it comes to hydrogen production and infrastructure.

Hydrogen, positioned as a strategic energy source for the future, has come under the spotlight in the global market, but it is still in the early stages when it comes to the development of the hydrogen industry. Petrochemical giants’ commitment will undoubtedly benefit the development of the hydrogen energy industry, but they also need to overcome various challenges of capital investment, technology, profitability and so on. We will be watching closely to see how petrochemical giants pursue the transition to low-carbon energy.

– Interact Analysis is a CFE Media and Technology content partner.