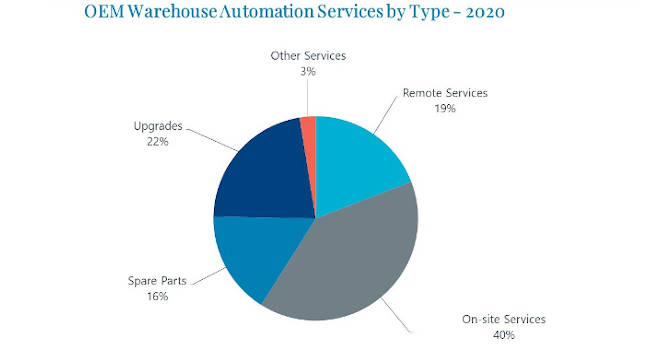

More than $4 billion was generated by OEMs and system integrators and the on-site presence was a large chunk of it.

In 2020, $4.3 billion in warehouse automation revenue was generated from after-sales services by original equipment manufacturers (OEMs) and system integrators. Of this, 40% was derived from the on-site category. This includes preventative maintenance, repairs, full-service contracts, and ongoing maintenance/operations support. Harnessing the in-person aspect of service will be an essential factor in expanding future service revenues.

Remote services feature high levels of acceptance

Remote services come in the form of hotline packages which customers subscribe to have telephone access to associates for troubleshooting and diagnostics. It is common for OEMs to have high rates of take-up of basic hotline service packages for their equipment, with 80-90% subscription rates being the norm.

Providers may offer differentiated levels of service with enhanced response times and off-hour access being charged at a premium. For example, a base-level response time could be within a 4-hour window. For an additional fee, this window could be shortened to 2 hours, 1 hour, or even within 30 minutes. With the relatively high rates of penetration, growing remote service revenues is highly dependent on the expansion of the installed base of systems.

The spare parts business is a “foot in the door” to the after-sales process

The sale cycle for spare parts begins upon system commissioning with the option of a spare parts package of critical components. Maintaining a robust spare parts business brings such logistical challenges like managing the geographic warehousing of parts for rapid dispatch or dealing with parts obsolescence.

While a proportion of customers (some providers reported as low as 20%) take the recommended spare parts package immediately at start up, it often forms the basis for a negotiation of price and contents of other services.

Modifications to existing systems are becoming more common

Upgrades and modifications include modernizations or alterations to existing systems to optimize performance or meet changing customer demands. However, it does not include full refurbishment or replacement of systems.

Normally, any modification to an existing system is likely to occur several years into the system lifecycle. However, in industries like general merchandise and apparel, vendors have been asked by customers to provide upgrades as early as one year into the project age to accommodate the rapid increase in e-commerce volume brought on by COVID-19. Upgrades can comprise 20-25% of a service providers service revenues and helps to maintain the incumbent’s position to win future full-scale refurbishments.

On-site services ramp-up organizational complexity as well as revenue potential

On-site services are when technicians employed by the OEM are deployed to the customer site. These include preventive maintenance visits for proactive inspections, field service to identify and repair problems with equipment, as well as ongoing on-site services where the technician works at the client site on a permanent of semi-permanent basis. Full-service contracts combining several discrete services are also included in this category.

Some vendors provide a level of regional autonomy to their subsidiaries in how to implement full-service contracts. Because technicians must be in close regional proximity to the customer site, the vendor needs the human resource capability to deliver those services reliably and without interruption. The full-service contract revenue must be enough to justify local hire costs.

With larger and more complex projects being deployed, resident onsite services are evolving to include the day-to-day operation of the equipment. The annual all-in customer costs for such services can amount to 10% of the project costs. In other words, the operating costs for a fully automated system can equal its initial project value in a matter of 10 years or less.

Predictive maintenance’s role

There are widespread efforts in developing predictive maintenance capabilities among the warehouse automation industry, especially if the vendors have already progressed to having a full-service offer. Data collection can take years to amass the information necessary for meaningful predictions. Interact Analysis believes that in the future, most predictive maintenance platforms will be used internally by service providers to better deliver on their customer SLAs and more efficiently organize maintenance resources as opposed to being a discrete service offer (and one that risks cannibalization of traditional service programs).

Final thoughts

Onsite warehouse automation services are already the dominant source of after-sales revenue and stand to offer the greatest growth potential in the coming years as the installed base of automation systems increases, customer downtime becomes more expensive, and OEMs organize a network of local technicians that can maintain and operate systems on a permanent basis. Of course, vendors are well advised to furnish a compelling business case to prospective customers if they wish to evolve their role from an equipment provider to that of a partner.

– This article originally appeared on Interact Analysis’ website. Interact Analysis is a CFE Media content partner.