Our last insight into the motion control sector looked at prospects for overall market growth up to 2026. We commented on the breadth of the market for the technology owing to its universal applicability.

Motion Control Insights

- The motion control market, largely consisting of the metal cutting machinery sector, is booming with the increased use of warehouse automation and demand for mobile robot technology. Research suggests that motion control sales within the mobile robot sector will see a CAGR of 52%. The textile and material handling machinery sectors are also projected to see significant increases.

- Due to shortages of parts and materials and an increase in demand, prices for motion control products are also increasing. The top suppliers for motion control products is APAC, specifically China, continue to lead because the Chinese market tends to perform better. Siemen’s, however, saw a decline in shares.

Motion controls such as servo motors are used in all industries where precise, controlled movements are required. When we consider specific applications and industries, it becomes clear that the market has strengths in certain sectors, and that it is always evolving. Let’s take a look.

100,000 mobile robots a year could be a major stimulus

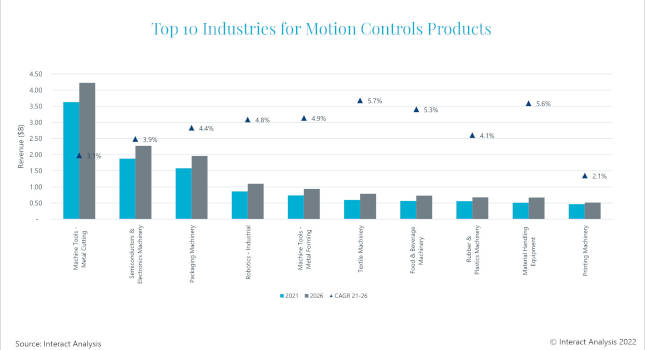

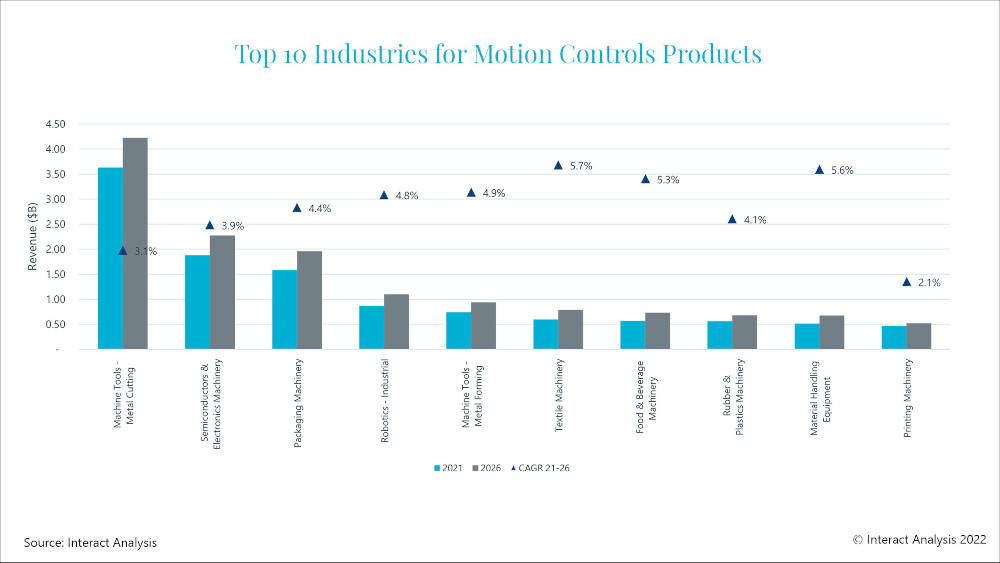

Traditionally, the biggest chunk of the motion controls market has been taken up by the industrial machinery sector. Machine tools manufacturers and semiconductor machinery makers have been among the top consumers. The metal cutting machinery sector is the largest consumer of motion control products, accounting for revenues of $3.6 billion in 2021. Meanwhile, semiconductors and electronics machinery, packaging machinery, industrial robots and metal forming machinery together accounted for $8.7 billion of sales in 2021, which made up around 60% of the total market. These industries will maintain their position as leading consumers of motion control technologies, but demand from other sectors is increasing significantly.

The unstoppable rise of e-commerce has increased the need for warehouse automation and this has resulted in a huge boost in demand for mobile robot technology. 100,000 mobile robots were shipped in 2021, and there is no sign of any let-up in demand. Our projections for motion control sales into the mobile robot sector during the forecast period indicate significant growth – a compound annual growth rate (CAGR) of 52.0% – way ahead of the CAGR for sales to the textiles machinery industry which is predicted to generate the second highest demand (CAGR of 5.7%) and the third, the material handling equipment sector, where we will see a CAGR of 5.6%. Our research indicates that by 2026 as many as 1,000,000 mobile robots could be required each year. This could be a huge opportunity for suppliers of motion control products.

Prices expected to stabilize after some significant recent increases

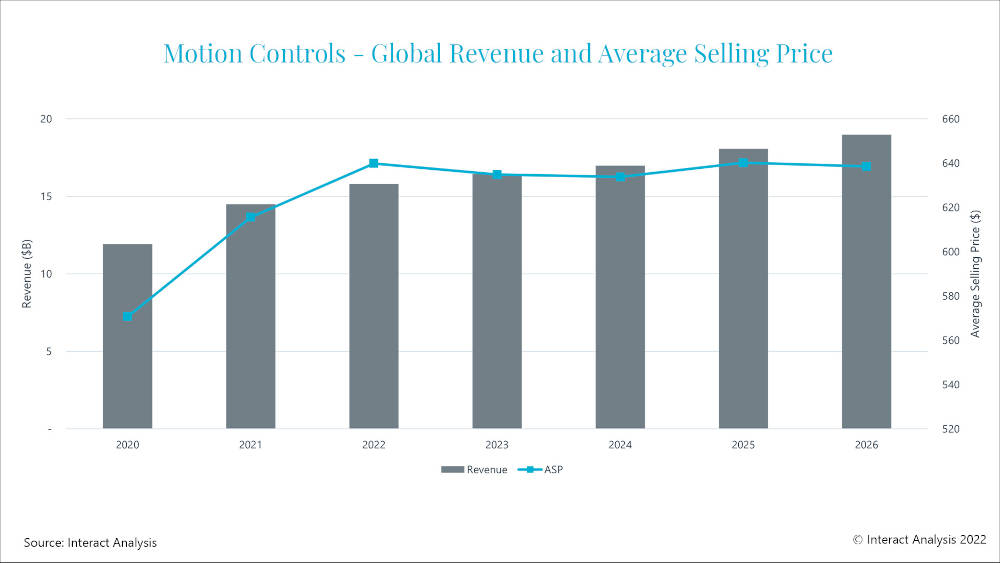

Shortages of parts and materials, as well as price increases for raw materials and components, meant that there was an across-the-board increase in pricing for motion control products in 2021, and this will continue into 2022. We predict that the blended average selling price (ASP) of a motion control product will increase from $570 in 2020 to $640 in 2022.

Company location is a significant factor in pricing, with, unsurprisingly, lower price increases being applied by APAC-based suppliers. Between 2020 and 2021, the average price increase in APAC was 4.6%, compared with about 7% for the Americas and Japan and about 6% for EMEA. An important factor here has been the easier access to raw materials and components in APAC, resulting in a reduced need to increase prices. Going beyond 2022, we anticipate relative stability in pricing, with only small fluctuations. We do not expect to see any significant price declines to be passed on to customers during the forecast period of this report.

Supplier landscape: Big players lose market share but Inovance and Delta Electronics gain ground

Since 2018, major motion control suppliers in APAC, have generally performed better than their counterparts in other regions. The main driver has been China, which accounted for about 77% of the region’s motion control products in 2020 as industries moved quickly to adopt motion control products as a way of increasing the sophistication and performance of the machinery produced in the region. Between 2018 and 2021, the top 4 suppliers remained the same, but Siemens market share declined by nearly 3%, and it could have declined even more had the company not had a strong presence in the burgeoning Chinese market.

Although the top four companies remain the same, there are signs that the overall market is becoming slightly less consolidated. The top 10 suppliers had a combined market share of 68.8% in 2021, and this declined to 65% in 2021. Some top suppliers have seen notable increases in market share since 2018, including Chinese company Inovance (+2.5%) and Taiwan-based Delta Electronics (+2.4%).

-Edited by Morgan Green, associate editor, CFE Media and Technology, [email protected].