JA Solar nearly doubled its PV module production in 2012, with its module production rising to 950 MW in 2012.

China’s JA Solar and Singapore-based Flextronics achieved the fastest growth among the Top 10 producers of photovoltaic (PV) modules in 2012, as the two companies cashed in on the soaring demand for contract manufacturing in the solar value chain.

JA Solar nearly doubled its PV module production in 2012, with its module production rising to 950 MW in 2012, up 96% from 490 MW in 2011, according to the "IHS Solar Integrated PV Market Tracker – Q1 ’13" from information and analytics provider IHS. This caused the company’s rank among global PV module producers to rise to No. 6 in 2012, up from 14th place in 2011.

Meanwhile, Flextronics increased its PV module production by more than 60% in 2012 to reach 900 MW, up from 540 MW in 2011. The company rose to seventh place in 2013, up from No. 13 in 2011.

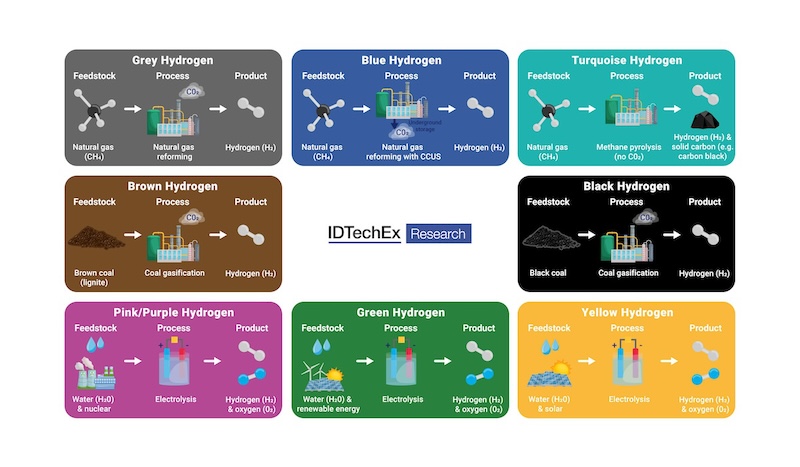

The chart below presents the global ranking of the Top 10 PV solar module makers in 2012 based on production.

"Despite the oversupply and price erosion that plagued the solar business though most of 2012, JA Solar managed to almost double its PV module production as it successfully transformed from the top crystalline cell producer into a leading module producer," said Jessica Jin, analyst for solar at IHS. "The company has now built a strong own module brand and could be well positioned for 2013."

Meanwhile, Flextronics is leveraging the contract manufacturing model that has been so successful in the electronics industry in the PV business.

"Flextronics has been largely known for its electronics and IT manufacturing services," said Jon-Frederick Campos, solar financial analyst at IHS. "Given the global market conditions, Flextronics seems to be transitioning its business model to put more of a focus on renewable energy. With many Chinese solar companies facing a tough struggle against antidumping and antisubsidy duties from the United States and the European Union, Flextronics is filling this void for Chinese PV companies."

The Top 5 module producers of 2012 were Yingli, First Solar, Trina Solar, Suntech, and Canadian Solar, each in 2012 producing between 1.50 and 1.95 GW of modules.

Robust production growth expected in 2013

The year 2012 was a tough period for module producers.

Reacting to the challenging market environment, module suppliers focused on clearing inventories and minimizing losses while also reducing factory utilization significantly.

Global module production growth decelerated dramatically in 2012, rising to 31.6 GW, up only 8% from 2011, according to IHS Solar. In contrast, the market expanded by 104% in 2010 and 31% in 2011.

IHS predicts that the 2013 growth will be substantially higher. Since module inventories have largely been sold off, the expansion of PV installations will be sufficient to drive a global module production of more than 37 GW this year, amounting to growth of 18%.

The portion of the business associated with OEMs is expected to grow at an above-average rate.

OEM shipments in 2012 expanded by a remarkable 51%, whereas total shipments increased only by 21%. With more and more suppliers seeking high-quality manufacturing partners to reduce cost, IHS projects this trend will intensify.

"By working with an experienced contract-manufacturing partner, companies can cut costs by 10% to 15%," Campos said. "At a time when pricing trends are uncertain, costs have become much more important to a company’s margins. Contract manufacturing can help to optimize the supply chain and solve many of the production problems with which PV suppliers are struggling."