Manufacturing demand remains strong in spite of the COVID-19, but workers are still adjusting.

U.S. factory activity accelerated to its highest level in nearly 2-1/2 years in December 2020, according to Reuters, citing the latest edition of the Institute for Supply Chain Management’s (ISM’s) Semi-Annual Economic Forecast, issued January 19.

The strength in manufacturing reported by ISM comes despite COVID-related absenteeism and short-term factory and supplier shutdowns to sanitize facilities.

The ISM’s index of national factory activity increased to a reading of 60.7 last month. That was the highest level since August 2018 and followed a reading of 57.5 in November. A reading above 50 indicates expansion in manufacturing, which accounts for nearly 12% of the U.S. economy.

At the same time, slower supplier deliveries indicate supply shortages related to the pandemic. Supply chain gridlock drives up costs for manufacturers and raises risks of higher inflation.

Nevertheless, demand for manufactured goods is strong as the resurgence in new COVID-19 cases has led to fresh business restrictions across the United States, largely impacting the vast services sector. Sixteen out of 18 manufacturing industries reported growth in December.

Despite strong demand, Reuters said, manufacturing output is still nearly 4% below its pre-pandemic level, according to the Federal Reserve. That could persist for a while as the new wave of infections causes disruptions for labor and the supply chain.

Growth in managed services

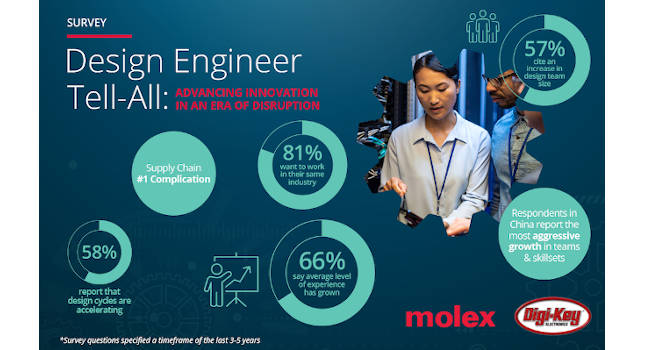

Sooner or later, one way or another, the pandemic will be behind us. As has been widely noted, it has given fresh impetus to trends toward, for example, digitalization. Digitalization, in part, is meant to address the fact that Deloitte and the Manufacturing Institute have estimated that up to 2.4 million US manufacturing jobs could remain unfilled between 2018 and 2028 because of a lack of adequate workforce skills.

One way to respond to this skills gap is to market the most highly sought skills as a service that can be contracted for by multiple manufacturers, rather than confining them within the four walls of a single employer.

According to ResearchandMarkets, the global managed services market is to reach more than $397 million by 2026, growing at a CAGR of 10.1% from 2018 to 2026.

With growth in managed services, business enterprises offload IT and other type operations to third-party services providers. A long list of services offered by these type providers include support and maintenance services, remediation services, security services, disaster recovery, managed storage, web and application hosting, and management of enterprise mobility, networks, databases and servers.

North America is estimated to have the largest market share during the forecast period due to the growing acceptance of the recurring revenue model, taking it out the CapEx column and placing it in that for OpEx.

Another leading indicator

Finally, November 2020 U.S. cutting tool consumption totaled $151.3 million, according to the U.S. Cutting Tool Institute and The Association for Manufacturing Technology. This total was down 9.9% from October’s $167.9 million and down 20% compared with the $189.1 million reported for November 2019. With a year-to-date total of $1.7 billion, 2020 is down 22.7% compared with November 2019.