PV module inventory is higher than expected, leading to some concerns about a drop-off in prices, though IMS expects things to return to normal by the end of 2011.

Back in May, we published a press release revealing that PV module inventory levels had reached a record of “over 10 GW” and predicting that prices would fall quickly as a result. Since then, we’ve been asked many times by worried suppliers to explain the figure, and tell them when we’d get back to ‘normal’ levels.

Firstly, I should point out that the majority of this inventory is ‘’channel inventory,’ which are the modules that are shipped by suppliers, but not yet installed, at a given time. These could be modules sent from China to warehouses in Europe, those sitting with wholesalers and distributors, or even those waiting for projects at installers. We carry out very detailed checks throughout the industry and supply chain to calculate this as part of our quarterly report on the industry. Of this 10 GW of inventory, we calculated that roughly 70% was channel inventory, and 30% was supplier-side inventory (i.e. in module suppliers’ warehouses).

Secondly, another important point to consider is that high inventory levels in themselves are not a problem. Any given industry, at any given time, will have a varying amount of product in the supply chain, and this is not a problem at all – as long as the product is moving. It only becomes a problem when something (e.g. Italian politicians and German feed-in tariffs) cause end-demand to slow suddenly.

One key question is, what is a healthy/normal amount of channel inventory? In some industries, such as the automotive industry, 6-12 months is not an uncommon amount of time between shipping major components and the final sale of the vehicle. In other industries, it would probably be a matter of weeks. Given how long it takes for a module to be manufactured, shipped, and then make its way through the supply chain before being installed; a normal time of inventory for PV modules is around 12-14 weeks. On this basis a ‘normal’ amount of inventory in June would have been around 5 GW – some 3 GW lower than reality.

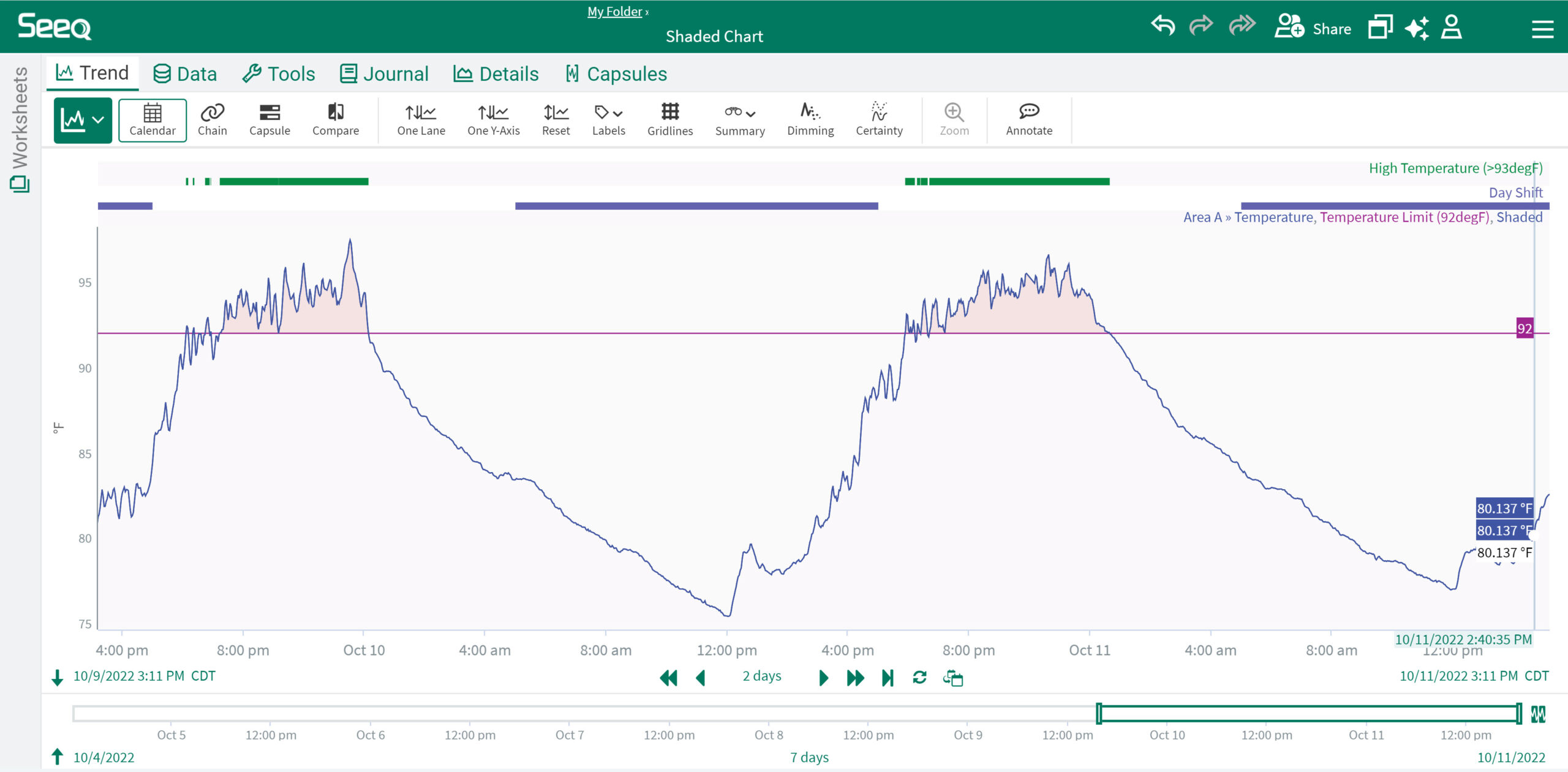

With this in mind, and taking into account the numbers shown in the graph below, inventory levels were actually incredibly low throughout 2010 (with the industry running at around 8-10 inventory weeks) due to the high levels of demand throughout the year. This has been ‘over-corrected’ going in to 2011 due to the sudden change in demand, and will remain high throughout most of the year. However, we predict that inventory levels will return to ‘normal’ by the end of the year.