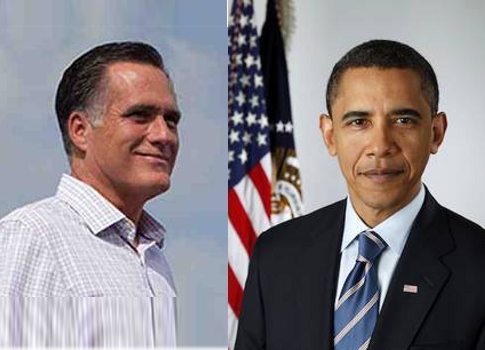

A closer look at some of the plans President Barack Obama and Presidential nominee Mitt Romney have in mind for the manufacturing sector.

It is springtime for manufacturing in America again.

The manufacturing sector is generally credited with leading the country out of the 2008 recession, and in the midst of the presidential campaign, manufacturing, job creation and growth and global trade have been the centerpiece of both campaigns.

CFE Media readers clearly understand the issues facing the industry. Job training and job creation are two interdependent issues. Reducing the tax burden on small business often is cited by readers as an important consideration. For those manufacturers stretching their markets to other countries, a fair and open global export system is important.

Republican Mitt Romney and Democratic incumbent Barack Obama have laid out their positions on these key issues, and with just a few weeks before the 2012 presidential election, Plant Engineering has taken excerpts from the two candidates’ position papers on these topics. Gov. Romney’s information is taken from his campaign Website; President Obama’s information is from the White House fact sheet following the State of the Union address in January.

Mitt Romney

Republican

The dynamism of the American workforce is our country’s greatest renewable natural resource. Jump-starting economic growth therefore requires that American workers have the skills that are needed to unleash their potential. One of the troubling features of the American economy today is the mismatch between the skill set of the American workforce and the requirements of the employment market. The gap between the two lies at the heart of our jobs crisis.

Over two centuries American workers have repeatedly proven themselves to be the most productive and the most capable at adapting themselves to changing economic conditions and embracing new technologies that come on stream. During that time, the American economy has also been the beneficiary of the extraordinary contributions made by the best and the brightest from around the world who have chosen to make our country their new home.

This combination has propelled the American economy to heights envied across the world. It can do so again.

Mitt Romney sees two important objectives that America can pursue immediately to build on the extraordinary traditional strengths of its workforce. The first is to retrain American workers to ensure that they have the education and skills to match the jobs of today’s economy. The second is to attract the best and the brightest from around the world.

Retraining Workers

Mitt Romney will approach retraining policy with a conservative mindset that recognizes it as an area where the federal government is particularly ill-equipped to succeed. Retraining efforts must be founded upon a partnership that brings together the states and the private sector. The sprawling federal network of redundant bureaucracies should be dismantled and the funds used for better purposes.

One particularly promising approach that Romney supports and believes states should be encouraged to pursue is a system of Personal Reemployment Accounts for unemployed individuals. These accounts would facilitate programs that place individuals directly into companies that provide on-the-job training—as governor of Massachusetts, Romney helped create just such a program.

- Eliminate redundancy in federal retraining programs by consolidating programs and funding streams, centering as much activity as possible in a single agency

- Give states authority to manage retraining programs by block granting federal funds

- Facilitate the creation of Personal Reemployment Accounts

- Encourage greater private sector involvement in retraining programs

Attracting the Best and the Brightest

To ensure that America continues to lead the world in innovation and economic dynamism, a Romney administration would press for an immigration policy designed to maximize America’s economic potential. The United States needs to attract and retain job creators from wherever they come.

Foreign-born residents with advanced degrees start companies, create jobs, and drive innovation at an especially high rate. While lawful immigrants comprise about 8% of the population, immigrants start 16% of our top-performing, high-technology companies, hold the position of CEO or lead engineer in 25% of high-tech firms, and produce over 25% of all patent applications filed from the United States.

- Raise visa caps for highly skilled workers

- Grant permanent residency to eligible graduates with advanced degrees in math, science, and engineering

Barack Obama

Democrat

Barack Obama is proposing the following revenue-neutral reform package to support manufacturing, discourage outsourcing, and encourage insourcing:

1. Removing tax deductions for shipping jobs overseas and providing new incentives for bringing them back home (revenue neutral): The tax code currently allows companies moving operations overseas to deduct their moving expenses – and reduce their taxes in the United States as a result. The President is proposing to change that. These deductions will be denied, and companies will no longer be provided deductions for moving their operations abroad. At the same time, the President is proposing to give a 20% income tax credit for the expenses of moving operations back into the United States to help companies bring jobs home.

2. Targeting the domestic production incentive on manufacturers who create jobs here at home and doubling the deduction for advanced manufacturing (revenue neutral): In conjunction with the President’s broader commitment to corporate tax reform, the Administration is proposing measures to provide incentives for manufacturing in the United States. The Administration is proposing to reform the current deduction for domestic production by more narrowly focusing it on manufacturing activities—for example, it would no longer cover oil production. These savings would be invested in expanding the deduction for manufacturers and doubling for advanced manufacturing technologies from its current level of 9% to 18%.

3. Introducing a new Manufacturing Communities Tax Credit to encourage investments in communities affected by job loss ($6 billion in credits): The President is proposing a new credit for qualified investments that help finance projects in communities that have suffered a major job loss event. This credit will provide $2 billion per year in incentives for three years. For this purpose, a major job loss event occurs when a military base closes or a major employer closes or substantially reduces a facility or operating unit, resulting in permanent mass layoffs. The tax credit would support qualified investments in this affected community – made in conjunction with State Economic Development Agencies and other local entities – that improve local economic growth.

4. Providing temporary tax credits to drive nearly $20 billion in domestic clean energy manufacturing ($5 billion in credits): The President is proposing to extend tax credits to drive nearly $20 billion of investment in domestic clean energy manufacturing, ensuring new windmills and solar panels will incorporate parts that are produced and assembled by American workers. This Advanced Energy Manufacturing Tax Credit – which was oversubscribed more than three times over – goes to investments in clean energy manufacturing in the United States. The additional $5 billion in tax credits the President is proposing will leverage nearly $20 billion in total investment in the United States.

5. Reauthorizing 100% expensing of investment in plants and equipment ($4 billion): The President is proposing to extend for all of 2012 a provision that allows businesses to expense the full cost of their investments in equipment, spurring investment in the United States. Over the next two years, this would provide businesses large and small with $50 billion in tax relief, with much of that recovered by the Treasury in subsequent years.

6. Closing a loophole that allows companies to shift profits overseas (raises $23 billion): Corporations right now can abuse the tax system by inappropriately shifting profits overseas from intangible property created in the United States. The President is proposing to close this loophole.